The Money Platform

Updated

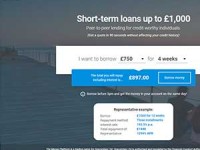

- Payday loans up to £1,000

- Low-interest starting from 193%

- Repayment up to 9 months

In-page navigation

Author The Money Platform. Screenshot of The Money Platform website. [Accessed May 17, 2020]

About The Money Platform

Encountering unexpected expenses that was not budgeted for is something we have all experienced. Often times these financial situations are overlooked by traditional lenders.

If you feel like you are not finding a quick, safe and reliable lender that offer short term loans for emergency funds, we would like you to know that The Money Platform is the answer you have been looking for.

Putting you in control of your finances

Our system is founded on the belief that financial services should give individuals control of their finances.

Why? Because lending and borrowing directly from one another benefits British people and not high end banks.

Trustworthy services

How do we do it? We provide a solution by connecting creditworthy borrowers who want to compare loans to trustworthy lenders. The idea turned out to be a viable one and The Money Platform was born.

Transparent and simple

To make the idea work, we built a transparent and simple platform for both borrowers and lenders.

The process is incredibly easy and it is the answer for all people seeking quick loans in the shortest time possible.

What makes our service incomparable?

Large financial institution in the middle of lending processes becomes an expensive system.

What we have achieved is great returns for lenders and borrowers receive lower cost, flexible personal loans such as payday loans from other individuals in the UK.

Because there are no banks involved, the decision making processes is quick, easy and straightforward.

The Money Platform Services

The Money Platform offers borrowers and lenders transactions in amounts between £250 and £1,000 for a period of between three weeks and three months.

The interest rate assigned to these payday loans range from between 0.3% and 0.7% interest per day.

What makes our lending different?

We run on considerably smaller operating costs than other lenders, which allows the savings to offer attractive returns and to our borrowers in the form of more competitively priced loans. This method of lending brings together lenders, seeking short term investments and borrowers looking for payday type loans.

Our platform takes care of the matching process. Lenders and borrowers are matched up according to specific investment and personal loan requirements.

We are a regulated lender

As a responsible lender we are authorised and regulated by the United Kingdom's Financial Conduct Authority.

Secured, trusted software

An external IT security company ensures that we are satisfied that all data logged in our system is safe and secure from any fraudulent activity and we will never share your personal information with third parties.

Transforming lending

We aim to transform how short-term borrowing works. Fair, simple and inexpensive loan services compared to our competitors is how we aim to do that. We can either automatically charge your bank the agreed repayment amount or you have the option of repaying manually prior to your repayment date.

Early loan repayment

You can repay your quick loan in full at any time and you will only be charged the interest up to the point of repayment including the loan administration fee.

The Money Platform Product Details

- Loan Type Payday loans

- Interest Rate from 193%

- Loan Amount up to £1,000

- Repayment 4 weeks to 9 months

Benefits of The Money Platform

- Same day loans

- Affordable payday loan options

- Apply with a bad credit history

Get the payday loan you need today!

It will only take a few minutes to register and apply for a loan on our website. Upon registration, you will know how much you are eligible to borrow.

Requirements to apply for a loan

- Identification document

- Be at least 20 years old

- Have a UK current account and a credit history that we can see

- Have a good track record of repaying debt

- Be a current UK resident

- Have three years of address history in the UK

- Be able to afford the loan

What makes The Money Platform a great choice for payday loans?

- Lower interest rates

- No hidden costs

- Straightforward online application process

- Same day loans

- Getting a quote will not affect your credit rating

- Flexibility to repay early

- Ethical lending practices

What can you use your loan for?

- A car or vehicle

- One-off events such as a holiday or wedding

- Home improvements

- Unexpected costs

We do not charge any fees

You can apply for a loan absolutely free of any charge. Should you finalise a loan, we make our costs clear and simple before you agree to our terms. We want you to fully understand your loan terms before you commit to anything.

Personal details required

We will need details about the following:

- your income

- rent or mortgage

- bank account

In order to process your payday loan application in the shortest time possible, it is important that all the details you provide is complete and accurate. You are not required to send any documentation through post as our entire loan procedure is done online.

The Money Platform is a trusted & reliable provider of payday loans

In our review, The Money Platform adheres to the compliance criteria in accordance with the Financial Conduct Authority, where the granting the loan will not cause financial distress to the consumer.

The Money Platform is a registered credit provider in the UK; FCA number 716455

Customer Reviews & Testimonials

The Money Platform Contact Details

Physical Address

- United Kingdom

- Get Directions

Opening Hours

- not available