Find out which business loan is ideal for you & where you should get it

Business loans are designed specifically for businesses of almost any kind. Business loans cover a large number of different business purposes from buying property to assets finance, and more.

Loans for start-ups

It is easier for companies that are already operating and have a stable track-record to obtain business financing. However, loans for start-up businesses are referred to as capital loans. It is not easy to get from traditional lenders. But there are options available at alternative online UK lenders and business start-up programmes.

Secured & unsecured business loans

Secured business loans are the most common amongst lenders. Collateral for a business loan includes property, assets such as machinery, equipment and more. Directors and business owners are also able to provide personal guarantees for business loans.

Unsecured business loans are available for small businesses that require some working capital. It is important to note that unsecured business loans are subject to higher interest rates and the loan amount is much lower than that of a secured business loan. The same applies to personal and debt consolidation loans where the secured option always offers a lower interest rate.

What is asset finance?

When businesses need equipment to ensure growth, they would apply for asset finance. There are two types of asset finance namely, leasing and hire purchase. Asset finance allows businesses to pay an amount for the use of an asset. The business, as such, avoids the cost of the product upfront.

Traditionally assets that were Durable, Identifiable, Moveable and Saleable (DIMS) were considered for asset financing. However, the asset finance industry, like everything else, has evolved in recent years and businesses now have access to a wider range of different types of lenders, and diverse types of asset finance.

Generally, asset finance has two categories. The assets that are to be financed are classed as hard or soft. Hard assets refer to assets that have a chassis or serial number and can include new and used equipment can be financed. For the purchase of a vehicle a business could opt for vehicle financing which would make more sense than taking out a general business loan.

Examples of hard assets

- Motor cars

- Light commercial vehicles

- Heavy commercial vehicles

- Agricultural machinery

- Buses and coaches

- Engineering (CNC) equipment

- Manufacturing equipment

- Printing presses and related print finishing equipment

- Recycling equipment

- Bulldozers, demolition equipment, excavators etc.

Soft assets usually do not have a resale value and if it does, it is usually limited. Soft assets are as a result mostly unsecured. Lenders usually approve asset finance loans for soft assets based on the strength of the business, and it is often subject to the owners or directors personal guarantees. You can apply for an asset finance loan by completing an online loan application or visiting the respective lender's offices.

Examples of soft assets

- Audio visual

- Catering equipment

- CCTV

- Epos systems

- Garage equipment

- Gymnasium equipment

- IT hardware and software

- Medical equipment

- Office furniture

- Scaffolding

What are the core purposes of a business loan?

Business loans are used to attain or do the following:

- To fund the start-up of a business

- To grow and expand a business

- To renovate business premises

- To buy furniture and office supplies

- To lease or purchase business property

- To lease or purchase equipment and/or machinery

- To buy commercial property

- For investment purposes

- For a cash flow boost

- Seasonal funding

- To purchase stock

- To pay staff

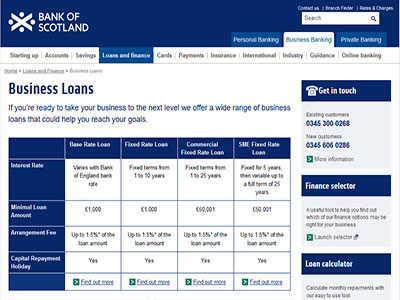

Comparing business loans

There is probably no other loan type more important to compare than a business loan. Each lender has a unique business loan product structure that will differ significantly from lender to lender.

Additionally, the eligibility requirements and supporting documentation required is much more extensive than for any other type of finance. Far more research will be required to ensure that you are receiving the best business loan in the UK. To start of your search for the best suited business s loan to meet your requirements, you should start off with a loan comparison website to accurately compare the products of each lender.

Due to the nature of a business loan, it would be recommended that you thoroughly investigate all your options before committing to a business loan.

Business loan alternatives

Business loans are not as easy to get as oppose to other types of loans. There are however alternative lenders that have made it easier for business to get the financing they need to grow or expand their businesses.

It is also worth considering whether your business qualifies for any government funded business initiatives, especially as a start up business. Other funding options such as applying for an overdraft to access quick cash for your business is another option are available. It can help your business with cash flow irregularities and shortages when necessary and it is an affordable alternative.

Overdraft facilities may also require security but it does allow you to access the cash immediately should you need a quick loan. This is a viable and convenient alternative for most small businesses.

Another option is that of a personal loan, which can be applied for by an individual. It might thus have a much more affordable interest rate with more flexible repayment term. A personal loan is easier to apply for, and the turnaround time should be quicker as well.

Other types of lenders for business loans

Peer to peer lending has become a popular form of business lending. It allows individuals to invest in local businesses, and as a result, it has funded many start-up and small businesses. It may also be easier to get as it is at the discretion of the investor to invest in your business proposal.

Peer to peer lending website offer businesses a platform, from which they can have contact with investors that are willing to fund their businesses. The personal approach of this type of business financing allows for far greater flexibility.

Another benefit of peer to peer lending is that it often does not depend solely on your credit record. It makes it easier for individuals to get the necessary financing for their existing or prospective businesses.

Peer-to-peer lenders allow you to submit a proposal on your business, which will then be added to a database that hundreds of investors have access to. You could see your business funded by one or more investors.