With or without security, these bad credit loan solutions are here to help

A bad credit loan is a loan that has been specifically designed for people with bad credit histories.

Although there are more lenders available for people with good credit histories, there are a number of bad credit lenders that offer solutions to those seeking loans with a less than perfect credit score. Often bad credit loans have higher interest rates and/or might require some form of security. Bad credit loans can be used for a variety of purposes from paying overdue bills to consolidating debt but, as they can expensive it is always a good idea to do a great deal of research to ensure you are making the most appropriate decision.

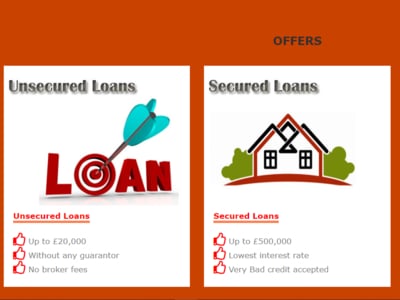

Types of bad credit loans

There are bad credit loans out there that may be unsecured but it is important to note that if unsecured it might have a significantly higher interest rate. A secured bad credit loan is secured by collateral, which can be in the form of equity in a property or a vehicle, for example. The one advantage is that secured loans have much lower interest rates and are thus more affordable. Bad credit loans work in such a way so that the lender can guarantee repayment of the loan should you default on repayment.

Where can I get a bad credit loan?

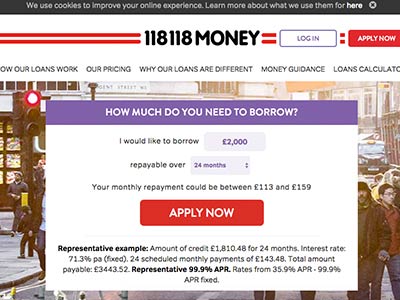

Most bad credit loans are offered by alternative online lenders. Online lenders generally offer lower loan amounts and shorter loan terms and there is a great deal of flexibility and features that sets each lender apart from the next.

Online bad credit loans are convenient as they are approved and processed via an online system, and almost never require the customer to visit a branch as customers can apply for a loan online. Consumers can find lenders that are not only willing to approve bad credit loans but they offer fully comprehensive online service and quick turnaround times, and speedy transfer of approved loan amounts. If you have bad credit or if you are blacklisted, we have the platform to find bad credit finance by some of the best lenders in the UK.

Minimum requirements to apply for a loan

If you want to apply for a quick loan, regardless of your credit score, you will still need to meet basic lending criteria before applying. It is important to note that the minimum requirements to apply for a bad credit loan are subject to each lender. Most of these requirements include but are not limited to the following.

- 18 years or older

- A citizen or permanent resident of the UK

- Are employed or self-employed

- You earn above a certain amount monthly

- You have a bank account and an email address

Fix your credit score with a bad credit loan

Bad credit loans can actually improve your credit rating if you keep up with the due repayments. However, should you default your credit score will certainly be affected. It is a viable option for individuals with bad credit to both access needed financing whilst improving credit scores. Responsible lending and borrowing are the key principles when looking to improve your credit score.

Comparing bad credit loans

By no means should you settle for a less than suited loan just because you are applying with bad credit. The financing industry is a competitive one, and thus you can still find a loan that is competitive amongst other bad credit loan offers with the desired flexible terms, rates and conditions. Ensure that you are fully aware of all the costs of a bad credit loan before signing your loan agreement.

Tips for comparing bad credit loans

By doing a complete loan comparison between multiple lenders using a reputable loan comparison site will ensure that you make an informed decision when choosing a lender. Many online lenders offer a quick pre-approval feature, which allows lenders to first do a soft search on your loan application. As it does not affect your credit report in any way, you will be able to know whether you qualify for a loan before finalising your loan application. It takes only a few minutes to complete and you should have an instant answer on your loan application.

Reasons why people choose bad credit loans

It goes without saying that the ideal is to have a good credit history. The truth is however; so many people have come to a point of bad credit for what should be understandable reasons. These individuals still need financing from time to time and this is where a bad credit loan really can do what no other loan type can, and that is provide bad credit loans to consumers. Here are some of the reasons why other people have chosen to apply for bad credit loans.

You don’t have to worry about your credit history – This is the core function of this loan type, and the most unique feature thereof. Bad credit lenders focus more on your ability to repay your loan as opposed to your credit history with previous creditors.

Easily apply and get a very quick approval – Due to the nature of the loan, approval rates are much higher than that of traditional lenders or banks. The process is fairly quick and does not require lengthy loan application procedures.

You are able to improve your credit – If you stick to your repayments, a bad credit loan will give you an opportunity to start getting positive feedback on your credit report.

Variety of loan amounts available – You can borrow fairly large amounts with a bad credit loan especially if you apply for a secured bad credit loan but you can also borrow small amounts as in the case of payday loans.

A secured bad credit loan is an option if…

- You own your home or have 70% or more equity in your home

- You own your motor vehicle

- You want to borrow a large amount of money

- You need a longer loan term

- You want to save money on interest and fees

An unsecured bad credit loan is an option if…

- You do not own your home or vehicle

- You have been denied a personal loan at other loan providers

- You are looking to borrow a small amount of money

- You can afford to repay the loan in a shorter term

- You are prepared to pay a higher interest rate associated with bad credit loans