Deal with emergency expenses like a pro with a fast cash loan online

A fast loan is ideal for emergency expenses as it is a quick cash loan approved within 24 hours that is entirely processed online. Fast or quick loans include payday loans and any other type of personal loan with a fixed loan amount and fixed loan term.

So, what are fast cash loans?

Fast cash loans include payday loans, short-term loans, bad credit loans and personal loans. These loans each have similar features in that they are usually smaller loans borrowed over a shorter period. Bad credit loans can also be included in the fast cash loans type.

When might you need a fast loan?

If you are in a situation we you need an instant cash loan to take care of emergency expenses, medical expenses, and more, a quick loan is probably your best option. Most payday lenders offer an online loan application that allows you to apply from virtually anywhere in the UK. It enables you to apply for loans on mobile phones or tablets, which is more in line with the busy lifestyle most of us experience.

What are quick cash loans used for?

- To pay urgent bills

- To buy groceries

- To pay for vehicle or household repairs

- Medical bills or school related costs

- For travel money

- To purchase goods

- For weddings, anniversaries and other special occasions

Where can you find a fast cash loan?

To find a quick cash lender in the UK is fairly easy as there are many available to consumers, leaving them spoilt for choice. Fast cash loans are available at online lenders, large banks and credit unions. A loan comparison site takes the guessing out of finding the best loan, in the fastest times possible.

Each type of quick cash lender has its own unique features, advantages, disadvantages, and more. By using our loan comparison website, you are better able to choose, which lender and loan type suits your needs best. It takes all the hard work out of finding the best fast cash lender in the UK.

Different fast cash lenders

- Peer-to-peer lenders

Peer to peer lending has grown in popularity in recent years as it often offers consumers attractive rates and are processed faster compared to traditional lenders.

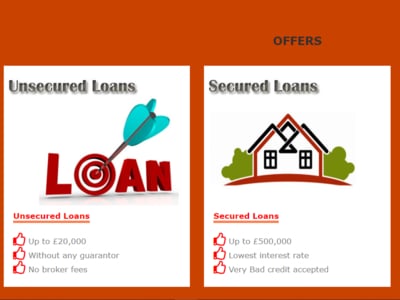

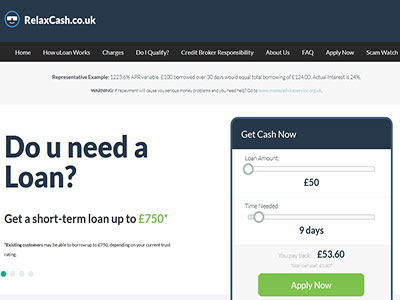

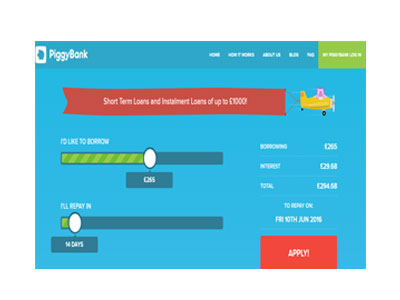

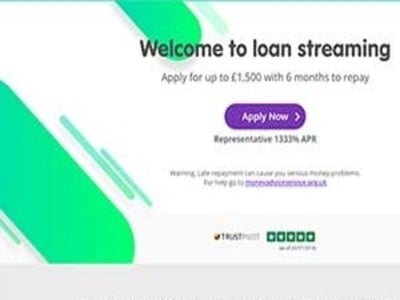

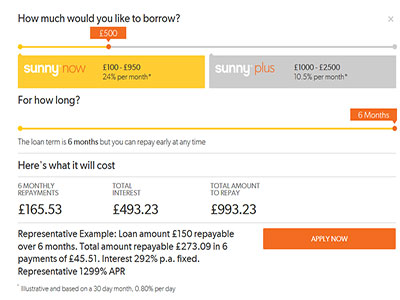

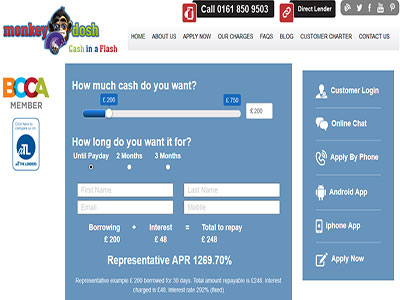

- Alternative credit providers

Small online lenders or smaller lending companies are referred to as alternative credit providers. They often specialise in payday loans and fast cash loans and often offer the quickest turnaround times on loans. Alternative credit providers have less stringent loan criteria compared to high street banks and other traditional lenders. It is therefore the best option for people who do not qualify for loans from these providers, or for individuals with bad credit.

- Traditional lenders

Our platform includes fast loan offers from more traditional lenders like banks and other credit providers. Consumers are guaranteed good rates, and perhaps higher loan amount. The loan application procedure might be a bit longer than those of other alternative lenders, but is still a viable option if you are not pressed for time.

The difference between fast loans and personal loans

You can have a fast loan approved in an hour whereas personal loans take longer with processing times averaging between three to seven days. However, this depends on each individual lender. It is also far easier to apply for a quick loan compared to the loan application for a personal loan. These are the most notable differences between payday loans and personal loans.

Benefits of a fast loan

- 24 hour maximum turnaround

One of the biggest advantages of fast loans is that you can have your loan the very same day - Approved loans in as little as 30 minutes

Some fast loan transfers can take place in only 30 minutes. You can choose a lender that best suits your turnaround requirements - Apply online via a simple online loan application

Applying for a loan online allows you to apply from wherever you are using a computer, mobile or tablet device - Apply 24 hours a day, seven days a week

As most fast loan lenders operate online, you have greater flexibility when it comes to when you apply - Apply with various income types

Whether you are employed, self-employed on benefits or even if you have bad credit, there is a loan type available for you - Apply with bad credit

People with bad credit are able to apply for loans, and get the financing they require but at times, at a higher interest rate

Do you qualify for a fast loan?

With so many fast cash loan providers most people can qualify for some type of loan. Usually fast loans especially payday loans are easy to apply for. Residents or citizens of the UK that are 18 years of age or older that provide acceptable proof of income to afford qualify for fast loans. The supporting documentation usually includes bank statements and/or payslips. It is not advisable to use a quick loan for any form of debt consolidation.

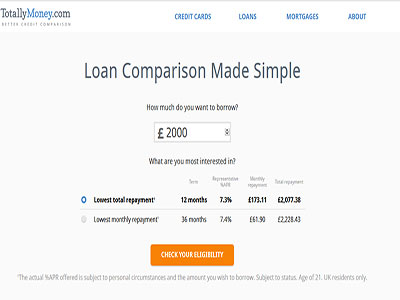

Best method to compare loans

A loan comparison website is the best bet when you are looking to apply for a loan. Our comparison site is a handy tool to find reputable lenders and the best rates in the country. And it does not take hours to do as all the important information has been conveniently compiled for you. It enables you to compare interest rates, fees, penalties, features and benefits of each lender. The APR is the most accurate representation of the all-inclusive fees you will be charged during your loan term.

Apply for a loan

Firstly, use our loan comparison website to find the best fast loan to suit your requirements. You can then narrow your search to your preferred lenders. There is a direct link to the website of the lender you choose, at which point you can submit your loan application. You will then be required to provide them with all of your personal, contact and employment details for verification - this may include a general rundown of your monthly budget. The loan application procedure might vary from lender to lender.