Combine your smaller debts into one simple personal loan

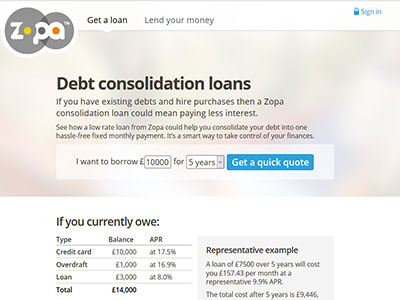

A debt consolidation is the combination of multiple debts into one bigger personal loan. It leaves you with one debt repayment instead of multiple repayments monthly. It offers a host of advantages but if misused, you can incur more debt.

Besides simplifying your budget and debt repayment, one of the other major benefits of debt consolidation is that you can save on the overall debt you would have paid on all your various debt repayments to other creditors; especially on high interest bearing credit accounts.

Additionally, debt consolidation allows you to lower your overall monthly debt repayment amount, which leaves you with a higher disposable income. This is a desirable feature for people that feel they have little or no money left after all debt repayment have been paid.

Why should you consider debt consolidation?

If you feel like you are overwhelmed by too many debt repayments per month, or if you feel over-indebted, debt consolidation could be the right financial solution for you. It makes managing debt easy as you only have one single payment to make per payment period.

As you have the option of a longer loan term, you can benefit from lower payments. It is beneficial to consolidate high interest accounts such as credit cards, as this will save you money on interest.

Debt consolidation service providers

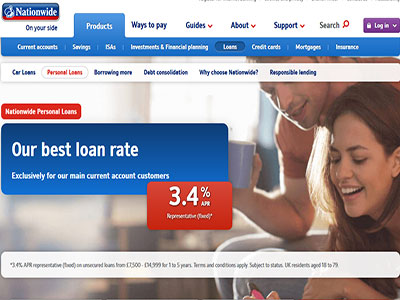

There is no lack of debt consolidation lenders in the UK. You can find debt consolidation loans at large banks, alternative lenders and online lenders. Typically, this loan type has lower interest rates and longer repayment terms to reduce the monthly debt expenses of loan applicants.

Consumers can also make use of various free advisory services, which will be able to access your financial position. You will then better know if you will benefit from debt consolidation.

The most important thing is finding a reputable lender. Our online loan comparison website allows you find the best debt consolidation loans in the UK. As the loan interest rates, terms and conditions are highly flexible and will vary depending on the respective lender, you need to ensure you are making the right choice.

It is also recommended that you get more than one debt consolidation offer in order to determine which suits your specific requirements. As the finance industry is a competitive industry, there is no shortage of affordable debt consolidation packages.

Benefits of a debt consolidation loan

- Lower your monthly debt payments by selecting a longer loan term

It is a sure way to make your debt more manageable and makes budgeting easier - Save money in the long run by securing a lower overall interest

You could save interest, especially on high interest bearing accounts - Better manage your debts with one payment and increase your disposable income

One of the biggest advantages of debt consolidation is that you can increase you disposable income, which instantly improves your daily lifestyle - Avoid defaulting on loan repayments

If you are in position where you feel like you are drowning in debt, a debt consolidation loan could help you to not default on debt repayments, and it will keep your credit record clear

Do you qualify for a debt consolidation loan?

Each lender has their own set of unique eligibility requirements and will access you financial situation accordingly. However, there are a few general requirements that are standard with most lenders.

- You must be aged over 18

- You must be a UK citizen or permanent resident

- You must have a stable address history

- You must be employed or self employed

- You must be able to demonstrate your affordability

- Most debt consolidation loans are secured with collateral

- A lender will look at things like assets, income and expenses

Other important information on debt consolidation

Upon loan application, a lender will assess your financial position, and your existing debts. The interest charged will then be compared to the debt consolidation loan interest to determine whether debt consolidation is right for you.

The most popular debts to consider include credit cards, store cards and unsecured personal loans or short-term loans, as these loans are unsecured they bear high interest. There are debt such as car loans and home loans that are not worth consolidating. It is important that you choose a lender that makes the debt consolidation process as clear and simple as possible.

Are you choosing the right consolidation lender?

The easiest and best way to compare debt consolidation lenders is to what Annual Percentage Rate (APR) they offer. Keep in mind that the lender will personalise your consolidation loan based on your credit score, loan amount and individual circumstances. The reputable lenders available on our platform offer pre-approval or debt consolidation calculator feature.

Before you complete any loan forms or make a formal online loan application, the feature allows you to see if you qualify, and whether debt consolidation is a sound financial decision for you to make.

Once you formally apply for a debt consolidation loan, the lender will run a credit check on you. This will appear on your credit file. However, the soft search eligibility check does not affect your credit score.

Use a loan comparison website

The most informative method to find a debt consolidation lender is to use a loan comparison website. Why? Because it allows you access to all the essential information on the most reputable lenders in the UK.

Our loan comparison websites allows you to view detailed information on debt consolidation lenders. You can as a result make an informed decision that ensures your financial wellbeing.

Benefits of using a loan comparison website to find a debt consolidation loan

- All the most important information compiled for easy access from one convenient platform

- It allows you to make informed consolidation decisions

- We only list reputable lenders on the comparison website

- Direct links to each provider for easy loan application

- It saves hours of your time searching for a lender

- Find a lender that suits all your personal requirements without compromising on what is important to you