P2P platforms connect willing investors with borrowers

Peer-to-peer (P2P) lending is unique, and does not operate the same as traditional lenders, large banks or private organisations. Rather peer-to-peer platforms connects willing investors with borrowers.

P2P lending in a nutshell

Peer-to-peer lenders are as a result a facilitator who matches people who want to invest with people who want to borrow, all from one convenient online platform. As P2P lenders operate via an online loan service, many operating expenses are not needed can consequently offer both investors and borrowers mutual, and major benefits. Investors are able to secure larger returns on their investments and borrowers can secure lower rate loans.

Typical characteristics of peer-to-peer lending

- May be conducted for profit but often has no fees

- No common bond or past relationship between lenders and borrowers

- The peer-to-peer lending company acts as the mediator

- All transactions take place online

- Lenders/investors may often choose which borrowers to invest in, should the respective P2P platform offer such a facility

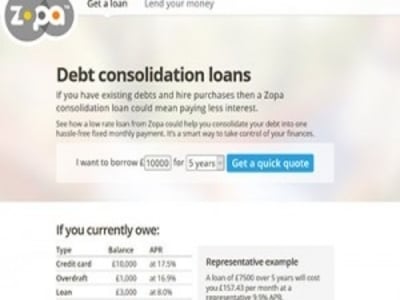

- the loans can be unsecured or secured, there can be protection funds such as offered by Zopa and RateSetter in the United Kingdom

A summary of benefits for borrowers

- P2P loans carry lower interest rates, and higher returns on investments

- The whole process of applying can be done online

- Save time as there is no need to fill in paperwork or gather supporting documents

- Businesses are able to link to their accounting software and avoid tedious document preparation

- No red tape means you can get a cash loan fast

- You can repay any P2P loan early with no penalty fees

- Since loans are processed online you can get your loan in 24 hours or less

- Lower rates on loans for borrowers

- Access larger personal loans without security

- Offer both personal and business loans at competitive rates

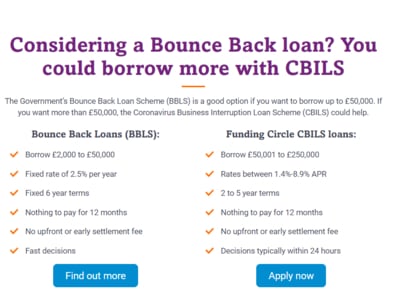

Types of P2P loans

Both personal and business loans are available via a peer to peer lending platform. Additionally, if you are looking for a very competitive loan to consolidate your debt, a P2P loan can offer the best financial solution. The peer to peer lending service allows you to apply for a loan without having to stand in a queue at a bank or filling in loads of forms and paperwork. All you have to do is register via the online loan application form and upload the supporting documents.

How P2P loans work

Peer to peer lending platforms are fairly simple. Investors looking for investments that guarantee higher returns invest their investment money into a marketplace lending platform in the UK. The investor is required to indicate their preferred level of risk and return ratios. The investors are then able buy a loan or loans.

Borrowers who are registered on the platform are required to complete a loan application online. Following this, the platform will verify their identity, run a credit check, and review their details for accuracy, which will determine if they qualify for a loan. Should the loan application be approved, it will be posted to a marketplace where investors will directly bid for your loan.

Qualify for a peer-to-peer loan

P2P lenders will in general have similar requirements as most other lenders. More often than not, you will be required to have a good to fair credit history to have your loan approved. At times, lenders will choose to approve bad credit loans, but the terms and conditions are subject to the respective lender. The following requirements are most standard among most lenders.

- You must be aged 18 or over

- You must be a citizen or a resident of the United Kingdom

- You must be able to provide your bank statements to prove your income

- You must be employed or self employed and earn a stable income

- You must be able to provide a photo ID

- You must have an active bank account

These are considered to be quite standard in the financial and lending industry but additional requirements and/or supporting documents may be requested at the discretion of the lender.

Whether you need a debt consolidation loans, a personal loan or a business loan with a low interest rate, a peer-to-peer lending platform will likely help you find a the lowest rates available.

Comparing peer-to-peer loans

Although P2P lenders offer some of the best rates in the UK financial market, it is important to keep in mind that the interest rate that you will be offered on your loan is subject to your credit score in most cases. With most loan types, the best method to know how much a loan will cost you is to look at the APR as a guide and then choose the most suited platform based on your specific needs.

Using a loan comparison website can help borrowers find peer to peer lending platforms that suit their needs. It ensures that you have access to the most important information of each lender before choosing your preferred peer to peer lender in the UK.

Peer-to-peer lending offers an attractive alternative to traditional lending

Peer-to-peer lending is not really a new concept to the UK but it has grown in popularity. It is a preferred choice as it offers competitive interest rates and more flexible lending criteria. P2P loans offer a range of benefits that cannot be matched by other types of lenders. If you are looking for a personal loan or a loan to consolidate your debts, a P2P loan may be the easiest and most affordable lending service for you. P2P lenders do not typically offer short-term loans or payday loans.

Socially-conscious investment

Another reason why peer to peer lending platforms have become popular is that it offers investors an opportunity for socially conscious investing, and supports and offer individuals an alternative to high-rate debt. It also allows investors to assist people who contribute positively or morally to the community. Alike, investors avoid investing in industries that are immoral and negative towards the communities, in which they operate.