1st Stop

Updated

- Personal loans up to £15,000

- Low-interest starting from 28.4%

- Repayment up to 72 months

In-page navigation

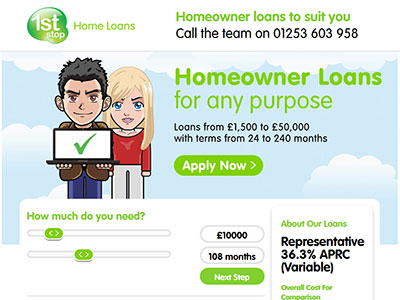

Author 1st Stop. Screenshot of 1st Stop website. [Accessed December 18, 2018]

About 1st Stop

1st Stop Personal Loans, and all our business dealings are underpinned by our core principles.

It is how we ensure that all our customers receive the very best loan service available. Ethical and responsible lending for our customers is one of the core principles of 1st Stop personal loans. These principles ensure that we are customer focused and that we act in line with our regulators expectations.

What are our core principles?

Delivering the best customer service - Delivering a high quality service that meet the individual needs of our customers, is what we strive to accomplish every day. Our team is made up of only the very best professionals who can deliver world-class customer service.

Responsible lending - As a responsible lender we are 100% committed to ethical and responsible lending whether you're taking out a short term loan or a or a larger personal loan.

A fair deal - The products and services we provide are fair, suitable and transparent. We ensure that all our customers receive a fair deal.

We understand our customers

The individual financial situations and needs of our customers are of great importance. Thus, we strive to understand each and every unique situation of each and every customer.

1st Stop Services

We provide personal loans up to £15,000 with repayment terms from 24 to 72 months.

You could have an answer within minutes, once you have applied online for a personal loan of your choice.

Our loans are suited to most circumstances and are repaid in single, monthly repayments.

What we guarantee

Customer-centred services and products - All our services and products are in the best interest of the customer and have been designed to help you achieve your financial milestones.

Trusted, regulated lender - 1st Stop Personal Loans are regulated by the Financial Conduct Authority (FCA). Our values reflect an open and honest lender with products and services comply with requirements as predetermined by Financial Conduct Authority.

Clear & fair information - All our loans are provided with clear and fair information, which is not misleading to our customers.

We’re here to help

We have a professionally trained team that are on hand to help customers every step of the way.

1st Stop Product Details

- Loan Type Personal loans

- Interest Rate from 28.4%

- Loan Amount up to £15,000

- Repayment 24 months to 72 months

Benefits of 1st Stop

- Soft credit search

- Loan applications take less than 10 minutes

- No obligation quotes

- Simple online application form

Applying for a loan is made easy by 1st Stop

Apply for a personal loan from £2,000 to £15,000. With 1st Stop, applying for a loan is straightforward and easy. All you need to do is simply complete the form below and you will have a decision in minutes.

Why are we a preferred personal loans lender?

- Personal loans up to £15,000

- Loans to suit most circumstances

- Loan terms from 24 to 72 months

- Single monthly repayments to keep outgoings simple

- Online decision in minutes with soft credit searching

Minimum requirements

- Must be at least 21 years old

- More than £15,000 annual income

- Available for homeowners

- Available for fair credit customers

- In employment for minimum of six months

- Resident in England, Scotland, or Wales

Depending on your unique circumstances, additional criteria may apply.

How to apply for a personal loan

Step one - To apply for a personal loan online, click the Apply Online tab and complete the application form. It is important that you provide all accurate information for your loan to be processed.

Step two - Once your online loan application has been submitted, the online system will approve your loan in principle or decline your application. Should you be approved in principle, we might require further information and one of our advisors will then contact you to discuss your application.

Step three - If you are approved in principle, you will receive an email containing a link, which will download your loan agreement as detailed below. You will also receive a pin code in a text message. Follow the steps as per instructions.

Step four - An advisor will be in touch to complete affordability checks and this may include verification of your employment and bank details. Once all of the above has been finalised, your loan funds will be transferred to your bank account.

How do I repay my loan?

You repayments will be collected from your debit card or by direct debit on the agreed repayment dates.

1st Stop is a trusted & reliable provider of personal loans

In our review, 1st Stop adheres to the compliance criteria in accordance with the Financial Conduct Authority, where the granting the loan will not cause financial distress to the consumer.

1st Stop is a registered credit provider in the UK; FCA number 723751

Customer Reviews & Testimonials

1st Stop Contact Details

Contact Number

Website

Physical Address

- 1st Stop Group 10 Whitehills Business Park Blackpool Lancashire FY4 5LW United Kingdom

- Get Directions

Opening Hours

- Monday 08:00 – 19:00

- Tuesday 08:00 – 19:00

- Wednesday 08:00 – 19:00

- Thursday 08:00 – 19:00

- Friday 09:30 – 17:30

- Saturday – Closed

- Sunday – Closed