Barclays

Updated

- Vehicle finance up to £50,000

- Low-interest starting from 7.3%

- Repayment up to 60 months

In-page navigation

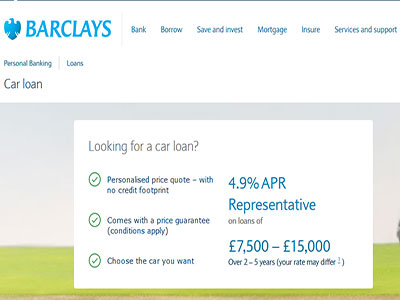

Author Barclays. Screenshot of Barclays website. [Accessed May 15, 2020]

About Barclays

Over many years of excellent service and trusted advice, Barclays has become a trusted name in the UK. Our staff are highly trained to maximize the customer experience and ensure your financial success.

We don’t offer short term loans or loans that are specifically designed as vehicle financing instead our online personal loans can be used in order to purchase a vehicle. Using a personal loan to purchase a car means that you won’t be subjected to the restrictions that are normally associated with car loans. Apply for a personal loan of up to £50,000 that can be used to purchase a vehicle. The amount that your loan will be approved for will depend on your individual level of affordability.

Receive a personalised loan rate

When you apply for one of our quick loans your information will be verified and we will customise the loan to suit your budget. If you have an account with us you can provisionally apply to see if you qualify without the application having a negative effect on your credit score.

The APR % on loans between £7, 500 and £15,000 is only 5.5% and you have up to 5 years to repay your loan.

Benefits of our online car loans include:

- Once approved the vehicle finance will be available straight away

- Apply online any time of the day or night and get an outcome in an instant

- Sign the agreement online if you would like to accept the quote

- Benefit from fixed monthly payments

Barclays Services

To make sure that you can afford the loan you can design the loan terms to suit your budget and decide how long up will need to repay the loan over how many instalments and if you want to pay weekly or monthly.

If you need more money to consider our personal loan top-up option this allows you to have access to additional funding.

You can choose your repayment terms and set up a direct debit that is aligned with your pay date.

In order to apply for our online loans you will need to:

- Have an active Barclays current account

- Be a resident of the UK

- You need to be at least 18 years old to apply

Before taking a test drive to discover your loan rate

We all want to purchase a dream car but purchasing a vehicle is a big commitment and shouldn’t be taken lightly. You need to ensure that you are able to afford the car loan.

Apply for a loan online and we will let you know exactly how much you qualify to borrow for before you start your search. Check how much you qualify for without damaging your credit score.

Barclays Product Details

- Loan Type Vehicle finance

- Interest Rate from 7.3%

- Loan Amount up to £50,000

- Repayment 24 months to 60 months

Benefits of Barclays

- Loans are paid out quickly

- Personalised vehicle finance quotes

- Apply for a loan in 10 minutes

With Barclays you can get a quick car loan from the comfort of your home

Our vehicle loans allow you to have the cash paid directly into your account so that you can have it on hand when you enter the car dealership.

Knowing exactly how much you have to spend will increase your bargaining power and find something in your price range. Our loans cover both new and used vehicles as well as private sellers.

Your budget will be the biggest deciding factor in how much money you borrow. The price you are willing to pay for the vehicle will determine the make and model as well as the fuel type. Research options on cars that are available to get a basic idea of their prices and special features.

Things to consider:

If you are buying a used car you should make sure that you inspect it for any damage and make sure that you aren’t buying someone else’s problems. Make sure that the car has never been in an accident and that all the vehicle part numbers match the DVLA’s records.

Take the car for at least a 30-minute test drive to ensure that there are no problems and you can see the driving conditions.

Trade in or sell your current vehicle

Another way to get your hands on a new vehicle is to trade in your existing vehicle. Make sure that you get the most money possible for your vehicle by having it evaluated at different dealerships and researching the price online. Make sure you are getting a good deal then use the money you get for your current vehicle as a deposit on your new car.

If you prefer to sell your car directly we will be able to assist you with a fair deal. Upgrade your wheels the simple way by applying for one of our car loans today.

Vehicle financing options if you don’t have cash

If you don’t have the cash on hand to buy a new vehicle then you can apply for one of our other vehicle financing options.

- Hire purchase

- Leasing

- PCP (personal contact payment)

- Or a bank online loan

Our consultants are there to offer you expert financial advice and guidance so that you can drive away in your new car as quickly as possible.

Apply online to see if you qualify and you will receive an obligation free quote. This will allow you to shop around with confidence until you find exactly what you are looking for.

Barclays is a trusted & reliable provider of vehicle finance

In our review, Barclays adheres to the compliance criteria in accordance with the Financial Conduct Authority, where the granting the loan will not cause financial distress to the consumer.

Barclays is a registered credit provider in the UK; FCA number 759676

Customer Reviews & Testimonials

Barclays Contact Details

Physical Address

- 86-88 Market St Manchester England M1 1PD United Kingdom

- Get Directions

Opening Hours

- Monday 09:30 – 17:30

- Tuesday 09:30 – 17:30

- Wednesday 10:00 – 16:30

- Thursday 09:30 – 17:30

- Friday 09:30 – 17:30

- Saturday 09:30 – 15:30

- Sunday 11:00 – 15:30