Sainsbury’s Bank

Updated

- Vehicle finance up to £15,000

- Low-interest starting from 4.9%

- Repayment up to 5 years

In-page navigation

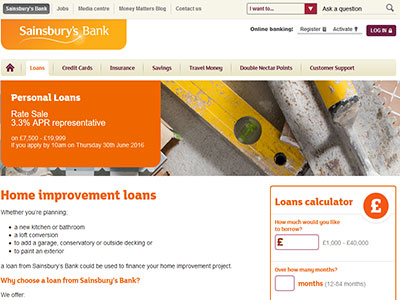

Author Sainsbury’s Bank. Screenshot of Sainsbury’s Bank website. [Accessed December 18, 2018]

About Sainsbury’s Bank

Sainsbury’s Bank is proud to offer award-winning range financial products and an attractive system for Sainsbury's shoppers.

It is the very reason why we have become a popular choice amongst UK residents. Our products include car loans, credit cards, savings as well as mortgages and life insurance. These services are provided online and by telephone.

We understand our customers

We are also proud of our heritage and what we have achieved. Sainsbury's was opened in and February 1997 and has since then been a leader in the banking and financial services industry. We believe that we understand what our customers require and we have designed our financial services and products accordingly.

We offer rewards and exclusive deals

As a Sainsbury customer, you will receive rewards and receive additional points. What's more is that you get to enjoy discounted rates on some of our award-winning financial products.

Repayment holiday

Helping our customers is what we like to do, thus you can choose not to pay your loan for the first two months during a repayment holiday. However, interest will be charged during the repayment holiday.

Sainsbury’s Bank Services

We finance car loans of up to £40,000 for new and used cars. A Sainsbury’s Bank car loan can help spread the cost of your purchase together with a host of benefits.

Why choose a car loan from Sainsbury’s Bank?

- A WIDE range of loan amounts from £1,000 to £40,000

- A PRICE Promise Guarantee

- CHOOSE to repay from one to seven years

- CUSTOMERS also have the option of a two month repayment loan at the commencement of their car loans, however, interest will still be charged

- WE OFFER fixed monthly repayments to suit your budget

Loan calculator for your convenience

We offer our client a convenient online calculator. It allows you to select a loan amount and preferred repayment term, and an overall cost on your loan. A personal loan from Sainsbury's Bank could be more affordable than you think. Simply use our calculator to find the ideal personal loan for you.

Lowest rates

The APR that applies to your loan will be determined by the information you provide and the loan you are applying for, including an independent verification of your credit and previous repayment behaviour and will range from 2.9% to 25.2% APR. Additionally, Nectar card holders qualify for our lowest rates.

Sainsbury’s Bank Product Details

- Loan Type Vehicle finance

- Interest Rate from 4.9%

- Loan Amount up to £15,000

- Repayment 1 year to 5 years

Benefits of Sainsbury’s Bank

- Quick online loan application

- Affordable loan deals

- Competitive interest rates

- Choose between car finance

We are a reliable, and trusted lender in the UK

Look no further for car financing that will work for you.

In order to apply for our personal loans, you would need to meet our eligibility criteria

Minimum requirements

- Be aged between 18 and 80 years old

- Have a UK based bank or building society account with a direct debit facility

- Have a permanent UK address

- You are required to be employment, self-employed or retired with a pension

- Earn a gross annual income of over £7,500

Required information

- Your residential address for the past three years

- Your sort code and account number

- Details of your monthly income and expenses

- Employment details

- Your Nectar card number, if you have one

Do you qualify for a car loan?

Use our soft-search tool, which will provide you with a preliminary decision on loan approval with Sainsbury's Bank and it will not affect your credit profile and is different from a full credit search. It allows you to know whether you qualify for a personal loan before officially applying for the loan.

Price promise guarantee

If you can find a lender to beat our rates on the same personal loan, we will beat it by 0.1%. Terms and conditions apply. Contact us today for further information on our price promise guarantee.

Support with your application

At Sainsbury’s Bank we provide you with professional, friendly customer support throughout your car loan application. Contact us to discuss your needs the support that you require.

Tips on car buying

We offer a guide to car buying that provides more information on buying a new or used car, finance options and other good resources to help with your research, and to help you make an informed decision.

Other services

For all your personal loan requirements, we are there to assist you. With a 3.0% APR representative, you can get a low loan rate on loan amount from £7,500 to £19,999. If you are looking for a personal loan from £1,000 to £40,000 over repayment terms of 12 to 84 months and competitive rates, we have exactly what you are looking for. Your personal circumstances, credit assessment procedures and other related factors will determine your personal rate.

Sainsbury’s Bank is a trusted & reliable provider of vehicle finance

In our review, Sainsbury’s Bank adheres to the compliance criteria in accordance with the Financial Conduct Authority, where the granting the loan will not cause financial distress to the consumer.

Sainsbury’s Bank is a registered credit provider in the UK; FCA number 184514

Customer Reviews & Testimonials

Sainsbury’s Bank Contact Details

Contact Number

Website

Physical Address

- 33 Holborn London England EC1N 2HT United Kingdom

- Get Directions

Postal Address

- Sainsbury's Bank Customer Relations PO Box 4952, Worthing, BN11 9YW, UK

Opening Hours

- not available