Bank of Scotland

Updated

- Vehicle finance up to £60,000

- Low-interest starting from 3.8%

- Repayment up to 7 years

In-page navigation

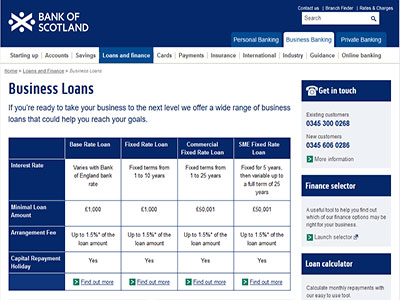

Author Bank of Scotland. Screenshot of Bank of Scotland website. [Accessed December 18, 2018]

About Bank of Scotland

Our history dates back to 1695 and we are Scotland’s oldest and most established bank. Proud of our heritage, we provide retail and commercial banking services.

We have always proven to be an innovator in the banking industry and we were the first bank in the UK to install a computer to process accounts in 1959.

Additionally, we first adopted online banking methods in 1985, which allowed customers to access their accounts remotely from their televisions via a telephone link-up.

Growing from strength to strength

Bank of Scotland has a footprint in all major towns and cities nationwide with over 290 branches and a mobile banking service.

We are proud to be the financial partner to over 2.8 million personal customers and 150,000 commercial customers.

Serving our communities

Bank of Scotland actively gives back to the communities it serves and has as a result created and maintained partnerships within your community. We take our community responsibility seriously and our communities have always been at the heart of what we do.

Our public commitments are facilitated through our Helping Britain Prosper Plan, which helps communities in a number of different ways.

Bank of Scotland Services

Offering our customers competitive car loans is only one of the expert services we provide.

If you are looking at buying the car of your dreams or simply looking to upgrade your current model, we would like to help you make that a reality.

Online exclusive loan

One of our expert car loans that is exclusively available to Bank of Scotland Internet Banking customers is the perfect solution if you are looking for vehicle finance is our online exclusive loan. Customers are able to apply for a car loan from £7,500 to £60,000 with a great rate of 3.5% APR representative when you borrow from.

Features of our Online Exclusive Loan

- 3.6% APR representative on loans from £7,500 to £25,000 over 1 to 5 years

- WIDE range of borrowing options: choose to borrow £1,000 to £50,000 over 1 to 7 years

- APPLY for and manage your loan online

- INSTANT decision when you apply online

- FLEXIBILITY to make additional payments

- REPAYMENT holiday option

Serving people and businesses

We have always been committed to serving households, businesses and communities prosper and reach new heights. Based on our dedication to service, heritage and expertise, we are a preferred lender among UK residents. We would like to make owning your dream car a reality.

Bank of Scotland Product Details

- Loan Type Vehicle finance

- Interest Rate from 3.8%

- Loan Amount up to £60,000

- Repayment 1 year to 7 years

Benefits of Bank of Scotland

- You can pay extra without penalties

- Easily manage your loans online

- Get an online decision within minutes

- Fast loan applications

The Bank of Scotland offers borrowing options suitable to your needs

Applying for the right type of credit option to finance your vehicle is important and should be done based on your personal circumstances.

Minimum requirements

- you must be a Bank of Scotland personal current account holder for a minimum of 3 months

- registered for Internet Banking

- aged 18 or over

- you must be a UK resident

Managing your loan online

Managing your finances should be as easy and convenient as possible and that is why we enable our customers to manage their loans online. Simply log in to Internet Banking perform the following functions:

- VIEW your loan statement

- MAKE additional payments

- GET an early settlement quote

- REPAY your loan early

- APPLY for a repayment holiday

Car Finance plus

It is easier than you might think to drive off with the car of your dreams. If you are looking to apply for car finance, get a no obligation quote with no credit searches, and it will not affect your credit report.

How does car finance work?

Customers borrow against the car that they are buying. We will then pay the car dealer directly once you have agreed upon all the details, and there are no upfront costs to worry about.

Our car finance features

- GET a no obligation quote with no affect on your credit score or report

- APPLYING online is simple and convenient

- MAJORITY of UK dealers covered

- REPAY early at no extra cost as we aim to save you costs

Your car finance options

You have the option of the following finance options:

Fixed car finance or otherwise hire purchase is an option with fixed monthly repayments until the end of the term, once all repayments have been made; you are the legal owner of the car.

Flexible car finance or otherwise personal contract purchase is where you make low fixed monthly repayments and you can either return the car at the end, or pay a final lump sum to own it.

Refinancing your vehicle

Are you looking to refinance your current vehicle? We can refinance your current car loan and you do not even need to change your car. Contact us to discuss all your refinancing options.

Bank of Scotland is a trusted & reliable provider of vehicle finance

In our review, Bank of Scotland adheres to the compliance criteria in accordance with the Financial Conduct Authority, where the granting the loan will not cause financial distress to the consumer.

Bank of Scotland is a registered credit provider in the UK; FCA number 169628

Customer Reviews & Testimonials

Bank of Scotland Contact Details

Physical Address

- 300 Lawnmarket Edinburgh Scotland EH1 2PH United Kingdom

- Get Directions

Opening Hours

- Monday 09:00 – 17:00

- Tuesday 09:00 – 17:00

- Wednesday 09:30 – 17:00

- Thursday 09:00 – 17:00

- Friday 09:00 – 17:00

- Saturday – Closed

- Sunday – Closed