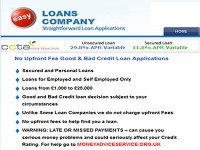

Easy Loans Company

Updated

- Loans Bad Credit up to £25,000

- Low-interest starting from 49.3%

In-page navigation

Author Easy Loans Company. Screenshot of Easy Loans Company website. [Accessed May 17, 2020]

About Easy Loans Company

Once a customer has a bad credit history, it tends to be difficult to be afforded any further credit. We, on the other hand, will still give you a loan regardless of the history you have.

This is because we want to help you do better. There will always be hurdles along your financial freedom journey and that is why Easy Loans Company is here to help get better with time. Whether you have a bad credit history or not, apply for our bad credit loans and let us be the one to determine whether we can approve your loan or not.

How much money do I qualify for?

The amount of money a customer qualifies for depends on the current personal loans you have. If you have a number of credit plans, the money might be significantly lower or you might not even qualify at all. However, if you have a good credit profile, we might be able to give a slightly better deal. The minimum amount a customer can get is £1,500 and the maximum amount is £25,000. We always encourage our clients to only apply for the amount that they need and nothing else. This is so that you don’t find yourself in a situation where you can no longer afford the loan you had initially applied for.

Have thought about debt consolidation?

If you are paying more than one credit plan and you feel like all of this is too much, you can always opt for debt consolidation. This is when you combine all your loans into one installment and end up paying for one combined loan instead of four for example. A lot of clients have found that this option works wonders and they often have money to buy other things that they may need during the month. At Easy Loans Company, our aim is to ensure that you are still able to do the things you enjoy and buy yourself all the things you couldn’t before.

Easy Loans Company Services

When you use a loan calculator before applying for credit, you are checking whether you will be able to pay for the bad credit loan or not.

This is a good idea because you will have an estimate and then you can be able to determine whether your loan can fit into the budget or must you find another alternative. At the end of the day, you should always do something that will ensure that you are still able to breathe and go on until the end of the month. Don’t bombard yourself with too much credit that will only ruin your credit profile.

How does the Easy Loans Company bad credit loan process work?

The first step is choosing the amount that you would like to apply for. After you have decided, you can complete the online loan application form which is available on our website. The customer should remember to always provide us with true and accurate details when applying. There might be additional documents that we might request from customers. These include your remuneration invoice as well as your bank statements. After this step, if we are satisfied with every document that has been submitted to us, you can expect the money in your bank account within two business days.

Easy Loans Company testimonials

We have found a number of clients keep coming back for our services because they are happy with the short-term loans we offer them. What is even better is the fact that the interest charges are slightly less and that makes a lot of customers happy. In return, this gives us joy too as an organization because it clearly means there is something we are doing right.

Easy Loans Company Product Details

- Loan Type Loans Bad Credit

- Interest Rate from 49.3%

- Loan Amount up to £25,000

Benefits of Easy Loans Company

- QUICK Loans

- PERSONAL Loans

- BAD Credit Loans

A credit provider that gives second chances

There are financial blogs that clients can make use of while they have accessed our website.

We upload these articles so that customers can learn a thing or two about budgets and overall financial management. This is also done so they can see what they are doing wrong. There are a number of ways of ensuring that you never walk the path of being a bad payer again and reading about financials can sure make things better.

Are you unhappy with our services? Please let us know.

If one of our agents have mistreated you and you feel like laying a complaint, please feel free to do so. We wouldn’t want our customers keeping information to themselves because, in return, we wouldn’t know what we are doing wrong.

Adhering to the Terms and Conditions

In order to ensure that you abide by the rules and regulations stipulated in the credit contract, you have to adhere to everything that is written in black and white. Every clause that has been referenced in the agreement can’t be taken for granted. Everything has to be adhered to in order for you to avoid getting penalties. The customer should familiarize himself with everything that is expected of him before agreeing to the terms and conditions of the overall bad credit loan application.

Customer Reviews & Testimonials

Easy Loans Company Contact Details

Contact Number

- not available

Website

Physical Address

- Bridgewater House, 58-60 Whitworth St Manchester England M1 6LT United Kingdom

- Get Directions

Opening Hours

- Monday 09:00 – 20:00

- Tuesday 09:00 – 20:00

- Wednesday 09:00 – 20:00

- Thursday 09:00 – 20:00

- Friday 09:00 – 14:00

- Saturday 10:00 – 14:00

- Sunday – Closed