Bank of Scotland

Updated

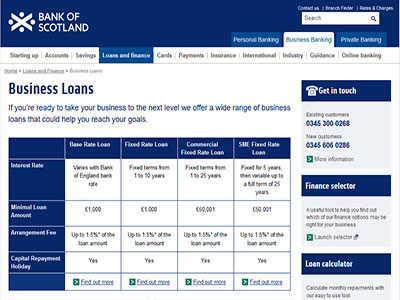

- Business Loans up to £500,000

- Low-interest starting from 7.1%

- Repayment up to 25 years

In-page navigation

Author Bank of Scotland. Screenshot of Bank of Scotland website. [Accessed May 15, 2020]

About Bank of Scotland

The Bank of Scotland is a commercial and clearing bank and was established on the 17th day of July 1965 and opened its doors for banking business in February 1996.

The Bank of Scotland was a very different institute to that of the Bank of England that was founded in 1694. Our history dates back to the 17th century and is the fifth oldest bank that has actually survived in the United Kingdom. We offer a range of financial services for businesses including business loans and accounts.

Let's look at our market strategy

We were forbidden to lend to the government without parliamentary approval. The instituting Act allowed the bank monopoly on public banking in Scotland for twenty-one years, allowing the bank's directors to increase a nominal wealth of £1,200,000 Scot Pounds and gave shareholders limited liability.

The Bank of Scotland history

The HBOS Group Reorganisation Act 2006 came about in June 2006 which was passed by the United Kingdom’s Parliament and with this came the simplified structure of the bank allowing the Company and Governor to become the Bank of Scotland plc in September 2007. On the 19th day of January 2009, the Bank of Scotland became a subordinate of the Lloyds Banking Group when HBOS and was controlled by Lloyds TSB.

Bank of Scotland Services

Do you have an idea that will move your business forward?

Whatever course you choose to take your business Bank of Scotland will support you in finding a lending solution best suited for your business.

We approve nine out of ten online loan applications as well as overdraft facilities.

Make use of our financial online tools

See how much you can borrow by making use of our calculator.

This tool enables you to see how much you’re able to borrow before applying for a business loan or overdraft there are also other options that you can try and will not affect your credit rating you’re also able to view indicative repayments and interest rates.

All our clients who use our this tool generally receive a final offer which is the same as calculated

Do you need another loan?

If you’re an existing customer and want to borrow - It’s easy, all you need to do is log into business internet and apply for your business loan, and you’re allowed to borrow up to £10,000.

Bank of Scotland Product Details

- Loan Type Business Loans

- Interest Rate from 7.1%

- Loan Amount up to £500,000

- Repayment 1 year to 25 years

Benefits of Bank of Scotland

- Apply online and get a decision within minutes

- Quick and easy loan applications

- Use the online loan calculator to determine repayments

Backup your application with our finance application checklist

Should you want to refinance an existing loan or if you’re applying for a new quick loan to help with cash flow, we find it of utmost importance that we understand the background to your application.

This will allow us to evaluate your ability to make repayments as well as choosing a product that best suits your needs. Our checklist below gives you guidance as to what type of information we may request in support of your application. Our questionnaire may vary depending on the amount you are requesting to borrow since no business loan application is the same. We may request further information depending on your circumstances.

- Borrowing requirements – The amount you would need to borrow.

- Term of the loan – The length of time you intend or would like to settle your loan

- Why you would like financing – Tell us about your business and why you need to borrow

- How will you make repayments? – We will need to know how you intend to repay the amount borrowed.

Tell us about your business plan:

Your business profile – About the owner or management team this should include expertise, experience and a track record. The amount you or your management team have personally invested in the business. Details of the assets offered as a guarantee and where they are located, together with a truthful estimation of their value, however, professional valuations may be required in certain instances and if you have any other credit commitments.

We may require additional information such as a business plan and Cashflow forecast, generally covering the duration of the long or short-term loan. Details of assets and liabilities, this should include any extra income from other sources. Management accounts such as profit and loss, cash flow statements and balance sheets.

The Bank of Scotland offers mobile banking for businesses

You’ll be pleased to know that our banking mobile was designed for a business like yours. It’s a great way to manage your business and know that it's secure; we like to call it business accounts on the go.

Whether you’re in the office or somewhere without your PC, on your way to another meeting or on your way home doesn’t matter because all it takes to access your account and get an online loan is a Face ID and fingerprint. It doesn’t get easier than that!

All you need is a Smartphone that runs iOS or Android and we’re able to test you the link to download the app on your request of course.

The Bank of Scotland is dedicated to supporting your business banking

We offer a wide range of accounts tailored to your individual business needs. Should you be seeking the convenience of daily banking? The Bank of Scotland has the right package for you!

It’s important to know that we only provide financial assistance for business use.

Customer Reviews & Testimonials

Bank of Scotland Contact Details

Physical Address

- 300 Lawnmarket Edinburgh England EH1 2PH United Kingdom

- Get Directions

Opening Hours

- Monday 09:00 – 17:00

- Tuesday 09:00 – 17:00

- Wednesday 09:30 – 17:00

- Thursday 09:00 – 17:00

- Friday 09:00 – 17:00

- Saturday – Closed

- Sunday – Closed