HSBC

Updated

- Become debt free

- Debt Consolidation up to £25,000

- One payment

- Low-interest up to 3.3%

- Lower interest

In-page navigation

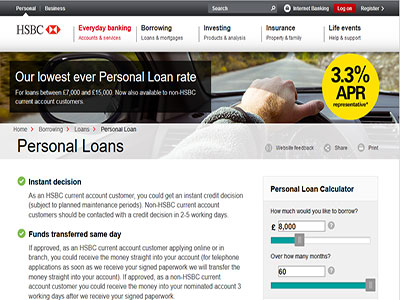

Author HSBC. Screenshot of HSBC website. [Accessed May 15, 2020]

About HSBC

When you find yourself in a difficult situation one of the biggest comforts is finding someone who knows exactly how to deal with the situation and the best way to resolve the problem.

As one of the world’s largest banking organizations, the HSBC has assisted over 39 million customers worldwide. We understand finance and we know how to make our customers happy. Change your world today by changing how you view your finances. From short-term loans to large loans for the purchase of a home, we can assist.

How can we help you?

As a bank that operates internationally, we have a widespread understanding of financial problems and how they impact individuals. What we have learned is that each individual is different and each individual requires a tailored deal for their financial circumstances and preferences.

We operate in retail, global, commercial and the private banking sectors so whoever you are we have something that will get you where you want to be including consolidation loans. Our major aim is to promote growth through healthy finance in order to create and realise our customer’s opportunities. Since 2018 we have been assisting the UK public to better manage their debt, properly invest their money and to lend responsibly. Take control of your financial future with the assistance of the HSBC – the time is now.

HSBC Services

Our staff is dedicated to offering the best possible service to our customers. This is why they are constantly offering friendly advice and assistance where possible.

We offer a wide variety of financial products that will make you smile. Simply complete the online loan application, contact us telephonically or via email and we can make arrangements from there!

Get a handle on your debt today

The time to take control of your finances is today. The problem with debt is that the longer you leave it, the worse the situation becomes.

If you find yourself drowning in debt then it can be time to consider a way out. A debt consolidation loan is an answer you are looking for.

We offer debt consolidation loans of up to £15,000 repayable from one to five years as well as larger loans of up to £25,000 repayable over a maximum of eight years.

This type of loan will allow you to repay all of your current debts and save money on total interest accrued as well as monthly charges.

The money saved can be contributed towards free overpayments meaning you can repay your loan even faster while saving money.

HSBC Product Details

- Loan Type Debt Consolidation

- Interest Rate 3.3%

- Loan Amount up to £25,000

Benefits of HSBC

- Transparent fees and rates

- Low-interest rates

- One affordable monthly payment

Banking at your earliest convenience

The best way to take your finances into your hands is to be able to handle everything at your own fingertips whenever it is convenient for you.

We are trying to revolutionise banking by avoiding long tedious queues and moving our banking to an online platform.

Banking on the go

With mobile banking, you can access your accounts, make payments, transfers or keep an eye on your debt consolidation loan status while on the go. Whether you are at the pub grabbing a pint with your friends, on the subway heading home or relaxing with a cup of coffee do banking the way you want to. Simply download our application off the App Store or Google Play and you can gain access to secure banking while on the move.

Bank the way that you feel comfortable

Is mobile banking not quite the thing for you? The good news is that we offer other ways to bank too. These ways include online-, telephone- and branch banking. This means that you can better manage your finance using your laptop, give us a call on the phone or step into one of our branches to talk face-to-face with a consultant. Bank the way that you prefer – we are here to make things as convenient for you as possible.

Individuality demands unique lending

As we stated above, each individual has their own unique financial circumstances and preferences. For this exact reason, we understand the importance of tailoring individual loan packages. Cookie-cutter loans are not an option at the HSBC which is exactly why our experts take the time to ensure that our customers receive the best possible deal, flexibility and loan type that suits their situation. One of the most attractive loans for this exact situation is personal loans. Personal loans allow the borrower to obtain finance for anything that their heart desires. Fancy a weekend away, need to send your wheels in for repairs or do you need to get better control over your debt? Whatever the situation is we can be of assistance!

We believe in being a responsible lender

As with most financial institutions and lenders, we have specific lending criteria which our applicants need to qualify against. We are a responsible lender and this means that we will only lend to an individual if we are sure that they will be able to afford the loan that they applied for even if it is a bad credit loan. For this reason, we only lend to individuals who are UK citizens over the age of eighteen with fixed employment and regular income. If you are concerned about the outcome of your application you can make use of our eligibility checker prior to applying which will not impact your credit score whatsoever.

Customer Reviews & Testimonials

HSBC Contact Details

Physical Address

- 88 Muswell Hill Broadway Muswell Hill London N10 3RX United Kingdom

- Get Directions

Opening Hours

- Monday 09:00 – 17:00

- Tuesday 09:00 – 17:00

- Wednesday 09:00 – 17:00

- Thursday 09:00 – 17:00

- Friday 09:00 – 17:00

- Saturday 09:00 – 14:00

- Sunday – Closed