HSBC

Updated

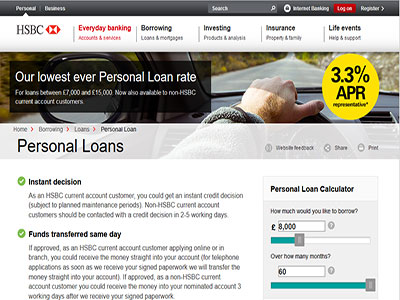

- Fast loans up to £25,000

- Low-interest starting from 3.3%

- Repayment up to 60 months

In-page navigation

Author HSBC. Screenshot of HSBC website. [Accessed May 17, 2020]

About HSBC

Have you been disappointed by a financial institution in the past? Do you feel like another number in the system?

It is our promise that you will not be disappointed by us. We are a global bank so we have a wide area of expertise and knowledge – no matter what your situation is we guarantee that we will take the time to understand it and tailor a fast loan to suit your precise economic needs.

Who are we at the HSBC?

The Hong Kong and Shanghai Banking Corporation (HSBC) is one of the largest banking and financial services collectives in the world serving over 39 million customers globally. Our banking network covers over 66 countries in Europe, Asia, Africa, North America, and the Middle East among other areas.

We have been providing financial products and solutions to our customers since 1865 and have since expanded into four major financial sectors, namely; Retail Banking and Wealth Management, Commercial Banking, Global Banking, and Global Private Banking. In July 2018 the HSBC UK was born to provide UK citizens with the same financial expertise that the rest of the world has been enjoying for over a century. With us you will never be just a number – we treat every customer as an individual to provide you with the service that you deserve. For financial assistance, look no further than the HSBC.

HSBC Services

When you require finance you need a lender that understands how to make the process as efficient as possible for you.

Our expert employees and advisers will assess your application as soon as possible in order to get the ball rolling. We offer a variety of fast loans including personal loans, home improvement loans, and debt consolidation loans. No matter what you require finance for, we can be of assistance.

Personal loans to suit your personality

When you take out a personal loan from the HSBC, not only will you be able to receive the much-needed money but you will also be able to obtain finance that is specifically designed around what you need. Short-term loans are nifty forms of finance because you are able to use them for anything that you need.

We offer personal loans from £1,000 up to £25,000 repayable over a period of one to five years at a fair and competitive interest rate.

Whether you would like to go on a road trip, make a large deposit on a vehicle or go on that well-deserved family vacation, we can help make it all possible with one little loan. Apply online for a payday loan today and get what you need before tomorrow.

HSBC Product Details

- Loan Type Fast loans

- Interest Rate from 3.3%

- Loan Amount up to £25,000

- Repayment 12 months to 60 months

Benefits of HSBC

- Settle early with no extra charge

- Top up your existing loan

- Get a quick loan decision

- Fast access to funds

Life is difficult enough but your finances don’t have to be

We understand better than anyone that life has its fair share of complications.

This is why we aspire to make all our financial products, services and processes as simple and convenient for you as possible. Messy debt is no issue for us – let us help you to get that organised with a debt consolidation loan. What about banking on the go? Wish granted – we now have a mobile app!

Debt control on the double

Debt can end up in different places – credit cards, loans, store cards; and these are only a few of the common sources. Life happens and you should not feel ashamed of that. We are here to help you get a handle on your debt for when times become tough. A debt consolidation loan allows you to repay all your current debts and pay only a single loan monthly. Make your life simpler, apply for debt consolidation today.

Banking on the move – what a time saver!

No one has time to stand in tedious bank queues anymore which is why we have designed a mobile app for your phone and tablet that allows you to keep track of your finances and make transfers and payments securely and conveniently. Our online loan application is available on the App Store and Google Play Store – get banking!

Take control of financial planning with our online calculators

At HSBC we believe in providing our customers with the tools necessary to equip themselves for a better financial future. Our online fast loan calculator will allow you to determine how much you are able to borrow and over how long you will repay the amount by examining the different possible monthly repayments. In order to successfully determine the amount of money, you are able to borrow you need to have a keen understanding of your past, current, and future financial circumstances. Get planning today to get the finance that you need.

Today is the day to pick up the hammer

Whether you have just moved into a new home, want to expand to allow for a larger family or want to add in a patio or pool a home improvement loan can help you to get your dose of DIY. We offer home improvement loans for up to £25,000 and the best part of getting a home improvement loan is that you are investing in your property. Any expansion or additions made to your home all add to the overall value of your property making home renovation a very valuable arrow in your quiver. So, not only can you impress the missus with your DIY skills but you can also add value to your property in the long run. No need to fight tooth and nail on this decision!

Customer Reviews & Testimonials

HSBC Contact Details

Physical Address

- 88 Muswell Hill Broadway Muswell Hill London N10 3RX United Kingdom

- Get Directions

Opening Hours

- Monday 09:00 – 17:00

- Tuesday 09:30 – 17:30

- Wednesday 09:00 – 17:00

- Thursday 09:00 – 17:00

- Friday 09:00 – 17:00

- Saturday 09:00 – 14:00

- Sunday – Closed