Peachy.co.za

Updated

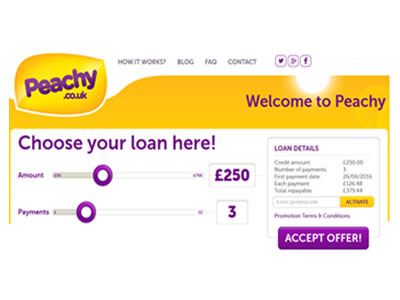

- Payday loans up to £1,000

- Low-interest starting from 248.37%

- Repayment up to 12 months

In-page navigation

Author Peachy.co.za. Screenshot of Peachy.co.za website. [Accessed May 17, 2020]

About Peachy.co.za

Peachy is a registered credit provider that offers payday loans to qualifying customers. There is nothing that makes us happier than seeing clients move forward in their financial lives.

While we can’t help everybody, we try our level best to guide you into a financial space that will make you comfortable. This is the reason we have established a sensible credit lending system that will not be too expensive to pay back.

A team of experts to assist you during your loan application

As young as we are with only a few years in the ranks, we have been able to receive more than 3 million online loan applications to date. An indication of this calibre means there is something we are doing right and we appreciate the support. The last thing you need when applying for credit is to be helped by consultants that don’t know what they talking about. Peachy has hired one of the best people in the market. Should a customer have any query they have about their payday loan application, one of our highly experienced agents will assist.

We respect your privacy

There is a confidential aspect that is administered between the two parties. No information will be shared with any other person that is not in connection with your application. The only reason we need your personal details is so that we can process your personal loan application and also verify everything you have mentioned in your credit request.

Peachy.co.za Services

Having access to your credit profile means that you will be able to make changes to your personal details as and when necessary.

The customer will also be able to keep frequent tabs on their quick loan and can even settle it soon than the scheduled payment date. This will give you some brownie points as we will see the level of financial determination you have towards your payday loan.

Struggling with late repayments?

We know that clients may encounter financial hiccups that may render it difficult to pay your loan on time. Please notify us as this happens as we will need to know how we can provide assistance.

The customer will be liable to pay charges should the payment not reach us on time. Failure to pay your payday loan on time may have a negative impact on your creditability.

Make sure you can afford the loan

This is the reason we always emphasize the fact that if customers will not be able to pay for a loan or rather aren’t too sure if they will stick to the financial obligations, they shouldn’t apply for credit. A lot of effort goes into fixing your credit once it has been tainted.

Rather find another alternative if you are not certain that you will meet the deadlines of paying your financial plan. If you need any other assistance with your credit, please send us an email or give us a call.

Peachy.co.za Product Details

- Loan Type Payday loans

- Interest Rate from 248.37%

- Loan Amount up to £1,000

- Repayment 1 month to 12 months

Benefits of Peachy.co.za

- Flexible loan terms

- A quick online loan application

- Get approved in minutes

At Peachy.co.uk you will get a quick payday loan, apply online today

Having access to your credit profile means that you will be able to make changes to your personal details as and when necessary.

The customer will also be able to keep frequent tabs on their loan and can even settle it soon than the scheduled payment date. This will give you some brownie points as we will see the level of financial determination you have towards your online loan. We will have no problem approving your loan application in the future if you meet all our requirements.

Struggling with late repayments?

We know that clients may encounter financial hiccups that may render it difficult to pay your loan on time. Please notify us as this happens as we will need to know how we can provide assistance. The customer will be liable to pay charges should the payment not reach us on time. Failure to pay your payday loan on time may have a negative impact on your creditability.

This is the reason we always emphasize the fact that if customers will not be able to pay for a loan or rather aren’t too sure if they will stick to the financial obligations, they shouldn’t apply for credit. A lot of effort goes into fixing your credit once it has been tainted. Rather find another alternative if you are not certain that you will meet the deadlines of paying your financial plan. If you need any other assistance with your credit, please send us an email or give us a call.

Why we don’t waste any time on getting back to you

The reason we don’t waste any precious time on getting back to the client who has applied for a payday loan is that we know that they usually want to make use of the money right away. If you apply for a loan in the morning, you would get feedback a few hours later but not later than the end of the business.

The fact that we work 24 hours a day and 7 days a week has simplified things for a number of clients who didn't apply to get some time off from their operational requirements. This means the customer can apply for a short-term loan the comfort of their own home or work office.

Peachy.co.za is a trusted & reliable provider of payday loans

In our review, Peachy.co.za adheres to the compliance criteria in accordance with the Financial Conduct Authority, where the granting the loan will not cause financial distress to the consumer.

Peachy.co.za is a registered credit provider in the UK; FCA number 674331

Customer Reviews & Testimonials

Peachy.co.za Contact Details

Physical Address

- 76 King St Manchester M2 4NH United Kingdom

- Get Directions

Opening Hours

- Monday 08:00 – 20:00

- Tuesday 08:00 – 20:00

- Wednesday 08:00 – 20:00

- Thursday 08:00 – 20:00

- Friday 08:00 – 20:00

- Saturday 10:00 – 18:00

- Sunday 10:00 – 18:00