Sunny Loans

Updated

- Payday loans up to £2,500

- Repayment up to 14 months

In-page navigation

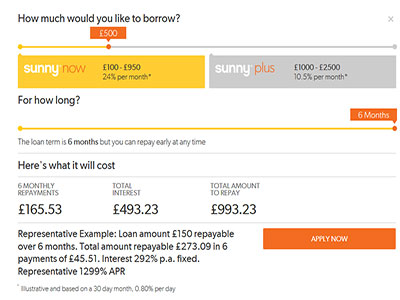

Author Sunny Loans. Screenshot of Sunny Loans website. [Accessed May 17, 2020]

About Sunny Loans

When we started this organization, we knew that we would be helping a number of customers when comes to their credit. In fact, this is the reason why we saw the necessity of opening this business.

Problems always seem to rise when you least expect it. It is for this purpose why you should always have back up. This is where we, Sunny Loans come in.

Our job is to ensure that clients are afforded payday loans when they need to attend to a financial emergency.

How do you help a client that doesn’t meet the criterion?

If your online loan application was declined, there could be a number of factors that contributed to this result. As a client, you need to look at the reasons given to you and work on them.

For starters, if your credit profile is not in good standing, we might have to turn down your loan application.

It is important that customers understand that we are trying to help them and not make them even more susceptible to money problems.

Want to increase your chances of getting your loan approved?

The best way of ensuring that you always get positive and uplifting feedback when you apply is to try and have an acceptable credit record.

We know and understand that you can never have a perfect credit score but you can at least try to have it at an acceptable rate. This can be achieved by not getting unnecessary short-term loans and only sticking to the priorities and nothing else.

Sunny Loans Services

If you would like to apply for credit, you have to access our website and answer all the questions. Everything is self-explanatory and there isn’t anything that might prove to be difficult.

Once we have received your quick loan application, we will go through everything and may request certain documentation. These could be in the form of your bank statements and proof of address. It is a mere verification procedure that we do to ensure that everything you have said and stipulated in the loan application corresponds with the information you have said in the credit request.

Can I apply for an additional loan?

Should you require an additional loan, you need to apply for another loan in the same format that you did with the first credit request. We do advise our customers to only apply for an advance if only it is necessary and important.

If you need money for something that can wait until your next pay date, you can always wait until then. There is no need to get credit for something that is not an urgent matter. This is where financial maturity and discipline has to take centre stage.

What are the credit requirements at Sunny?

In order to qualify for a payday loan, you need to be 18 years and older. The customer must be a UK resident and you should be employed and earn a salary. The client also needs to have a mobile phone.

Without these requirements, we might not be able to help you get your personal loan. Our credit services were designed for short-term borrowing; if you need something long-term, please inform us. The last thing we want is to realize that the reason you are paying your loans late is that you thought they were long-term instead of short-term.

Sunny Loans Product Details

- Loan Type Payday loans

- Loan Amount up to £2,500

- Repayment 30 days to 14 months

Benefits of Sunny Loans

- PAYDAY Loans

- PERSONAL Loans

- QUICK Loans

Payday loans with fast payout times, just the way our clients like it

The customer can make use of the eligibility checker before applying. This way, they will know prior to applying whether they qualify for a loan and how much would they be due to pay.

A number of clients have used this eligibility system and it has worked for them because they even know the interest charges.

What are the implications of late payments?

If you pay your loan later than the required date, you will have pay for the interest charges and this will ruin your credit profile.

Putting a stain on your credit profile isn’t ideal if you are still looking to get approved for credit in the future. The only time you should apply for an online loan is when you feel that you don’t have another alternative. The customer should always ensure that there will be sufficient money on your bank account on the day of your debit order.

Struggling to make payments?

If you are struggling to pay your loan, please inform us in due course. Don’t wait until the date of your debit payment.

We know that these things happen and we are also human so we will not be too hard on you. The client will have to cover up the extra charges that will be made on the absence of paying your loan on time.

How long does it take the money to reflect on my bank account?

Depending on the bank that you use, the money might be deposited in your bank account within hours or even less. One business day is all it takes for our payday loans to reflect on your bank account.

Customer Reviews & Testimonials

Sunny Loans Contact Details

Contact Number

Website

Physical Address

- United Kingdom

- Get Directions

Opening Hours

- not available