Zopa

Updated

- Peer-to-Peer Lending up to £25,000

- Low-interest starting from 17%

- Repayment up to 60 months

In-page navigation

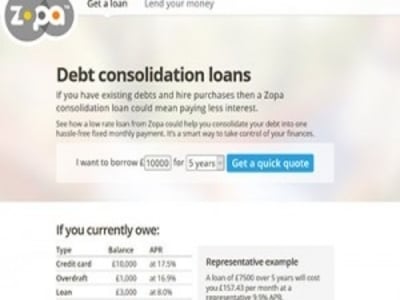

Author Zopa. Screenshot of Zopa website. [Accessed May 14, 2020]

About Zopa

Zopa is all about simple loans and smart investments. Why should loans hold you back?

We believe that persona and business loans should help you, and if you are investing, an investment should be rewarding, and at the same time ethical.

Shaping the finance future

By offering competitive rates, flexible and fair products with award-winning customer service, we are shaping the financial future one step at a time. Our main aim is to make money simple and fair for everyone. We offer a platform to enable people achieve more with their money and take control of their finances.

All about us

Since 2005, investors and borrowers have trusted us and the services that we offer. We have over 200 dedicated Zopians working in our London Bridge office and have lent more than £2.56 billion to UK consumers. The last 12 months we have lent just over £800 million. We have a strong platform of over 60,000 active individual investors and over 277,000 borrowers have been approved so far.

Innovative lending platform

Our technology and data nature has helps us earn our reputation of an innovator that delivers with an exceptional customer experience. We are so proud of the fact that a number of financial institutions also invest through our peer to peer lending platform.

Zopa Services

How does Zopa work? Well, firstly we are proud to do things differently.

We have done so with the Zopa model, which was the first of its kind in the world. We have created a pioneering peer to peer lending platform that works for both borrowers and investors.

What do we do?

At Zopa, we directly match individuals seeking a low rate loan with investors looking for a higher rate of return. Our service works because it is efficient and online. With lower overheads, we are able to offer the best online loan rates in the industry.

How do we make money?

All our business is operated on the principle of transparency and our fees are displayed clearly to our customers should they take out a loan or invest their money.

- Loan customers

Loan customers are charged an origination fee to help cover the cost of setting up the loan. A peer-to-peer loan servicing fee to each loan contract will also be charged and will be deducted directly from each borrower repayment.

- Investors

Investors are charged a 1% fee if an investor wants to sell their loans to access their money quickly. There are other free ways to withdraw funds.

Zopa Product Details

- Loan Type Peer-to-Peer Lending

- Interest Rate from 17%

- Loan Amount up to £25,000

- Repayment 365 days to 60 months

Benefits of Zopa

- Peer-to-peer lending

- Apply for a loan within minutes

- No fees and paperwork

At Zopa, we do things differently!

Applying is as simple as following the three steps below.

- Choose how much to borrow and repayment term

Customers are able to apply for personal loans from £1,000 to £25,000 over one to five years. - You will receive your personalised rates in three minutes

All you have to do is complete simple form to tell us a few details about you and your circumstances. This will not affect your credit score in any way. - Apply online and get a decision within two working days

You may be required to provide proof of your identity, income or bank account, which can all be done online at your convenience.

Fast track option to receive your funds

Should your online loan application be approved, the money will be with you within three working days. However, should you require the funds urgently; you have the option of choosing our Fast Track option for £10, which will enable you to get the funds within one working day after approval.

New investors

We will send you an email with a personal link to open your account if you are accepted as an investor. All you have to do is select a product, which will be the automatic choice for new funds and to invest your money. The money you have submitted to for investment will then enter into a queue with other lenders to be matched to borrowers looking for peer-to-peer loans, which typically takes a week.

We are here to help

We are here to assist you from Monday to Friday. Please feel free to contact us via email or telephone should you require any assistance. One of our friendly staff members will help you throughout the entire process.

Zopa is a trusted & reliable provider of peer-to-peer lending

In our review, Zopa adheres to the compliance criteria in accordance with the Financial Conduct Authority, where the granting the loan will not cause financial distress to the consumer.

Zopa is a registered credit provider in the UK; FCA number 800542

Customer Reviews & Testimonials

Zopa Contact Details

Physical Address

- 47-49, Cottons Centre, Tooley St London England SE1 2QG United Kingdom

- Get Directions

Opening Hours

- Monday 08:00 – 20:00

- Tuesday 08:00 – 20:00

- Wednesday 08:00 – 20:00

- Thursday 08:00 – 20:00

- Friday 08:00 – 17:00

- Saturday 08:00 – 17:00

- Sunday –