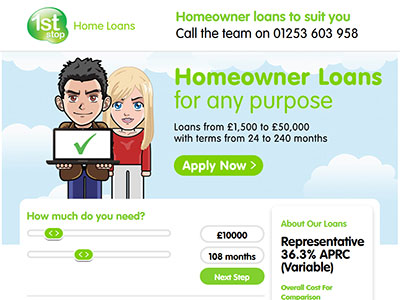

1 Stop

Updated

- Property Finance up to £50,000

- Low-interest starting from 37.5%

- Repayment up to 10 years

In-page navigation

Author 1 Stop. Screenshot of 1 Stop website. [Accessed May 14, 2020]

About 1 Stop

It is quite rare to find someone that is not looking to own a home. The reason might be due to the fact that their finances are not in a good state but everyone would like to have a title deed that has their name next to it.

At 1 Stop, we understand this all too well. This is why we go out of our way to ensure that customers get their home loans approved regardless of their credit profiles. The only time we might be able to assist is when your affordability doesn’t meet our minimum requirements. We do strive to ensure that we can help everybody we meet.

Nobody has a perfect credit

Financial mistakes or misjudgments do happen. There is a discrete credit score that clients need to meet in order for their online loan application to be approved. Failure to meet the required criterion will result in a credit declination.

Disapproving your mortgage credit request at the present moment doesn’t stop you from applying again in the future. If you feel that there are certain expenses you have paid off and your affordability is slightly better than before, you can apply. Renting out an apartment might be ideal for a few years but not for a lifetime. Owning property has advanced to be a need as opposed to it being a want.

A short and long term home loan option

If you are looking for a personal loan option that is short such as 24 months, you can opt for that opportunity. On the other hand, if you are looking for something long term, you can apply for credit and pay the home within 240 months.

At the end of the day, the customer knows his finances and if you feel that you can cope with 24 months, you are more than welcome to apply for that selection. The customer has to ensure that they never skip any payments as this will result in serious financial charges.

1 Stop Services

The first step when it comes to applying for a mortgage at 1 Stop is completing the online loan application. After you have completed the application, additional documents may be required since it is part and parcel of our credit process.

We will notify the customer whether or not their application was approved or not and may request additional information on credit cards, loans and other financial matters.

We will also try to advise where possible on how you can increase your chances of being granted a thumbs up in the future.

When will I know if my application was approved?

A day is all it takes and we will notify you about the status of your loan.

Should you feel that a debit order system is a method you want to use to pay your loan, you can sign up for it.

There are certain documents that will be sent to you to read and sign off.

The customer needs to send back those documents as soon as possible so that we can carry on with the process of the loan.

What are the requirements for a home loan at 1 Stop?

Owning a home is one of the criteria that need to be met at 1 Stop. If you don’t already own a home, it may prove to be quite difficult to get credit.

Ensure that you are good financial standing if you would like to apply for property finance or, you might not be able to maintain consistent payments.

1 Stop Product Details

- Loan Type Property Finance

- Interest Rate from 37.5%

- Loan Amount up to £50,000

- Repayment 24 months to 10 years

Benefits of 1 Stop

- Quick and easy home loan applications

- Flexible loan options

- Settle your loan early without penalties

Buying your dream home is just one online loan application away

1 Stop will never borrow someone who is clearly not in a good financial position to accept another loan as they have a car loan and possibly other personal loans outstanding.

We make sure that the loan applications that we approve are for people who will be able to pay for the credit requests they are applying for. There wouldn’t be any justice we are doing on giving clients that are already paying for too much credit an additional home loan.

I can’t pay my home loan on time

If you are struggling with your loan and might pay your loan later than the scheduled date, please inform us as soon as possible. Don’t wait until the day of your debit order to tell us.

There will be interest charges incurred but we will appreciate the gesture of being informed prior to the event happening. We understand that unplanned things tend to happen when you least expect it and this may also come between you paying your loan on time.

What are the implications of not paying my home loan?

Consistent failure to pay your home loan may result in us having to repossess your home. Clients need to make sure that they can afford the home loan that they are applying for to afford certain financial repercussions.

Give us a call or send us an email if you are facing financial difficulty and would like to propose new payment plans. We will help you through whatever it is that you are going through. Although, the customer also needs to do their end of the bargain and maintain credit payment consistency.

1 Stop is a trusted & reliable provider of property finance

In our review, 1 Stop adheres to the compliance criteria in accordance with the Financial Conduct Authority, where the granting the loan will not cause financial distress to the consumer.

1 Stop is a registered credit provider in the UK; FCA number 723751

Customer Reviews & Testimonials

1 Stop Contact Details

Physical Address

- 10 Whitehills Dr Blackpool England FY4 5LW United Kingdom

- Get Directions

Opening Hours

- Monday 08:00 – 08:00

- Tuesday 08:00 – 08:00

- Wednesday 08:00 – 08:00

- Thursday 08:00 – 08:00

- Friday 09:30 – 17:30

- Saturday – Closed

- Sunday – Closed