Aqua

Updated

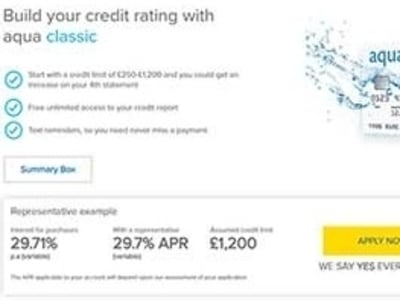

Author Aqua. Screenshot of Aqua website. [Accessed May 14, 2020]

About Aqua

Aqua provides credit cards, even to individuals who do not qualify for credit cards provided by traditional lenders and high street banks.

Issued by one of the UK’s leading specialist credit card providers, our success is due to affordable lending with fair and transparent pricing. Exceptional customer service is something we feel strongly about and we deliver accordingly.

Proudly based in the UK

We are proudly based in the UK with local customer service agents who are happy to help all customers that turn to us for credit card facilities. Our quick loan approval decisions are based on your particular circumstances as we understand the financial situations of our customers are all unique. As a responsible lender, we will provide you with tools to help you gain control of your finances, and help rebuild you credit rating.

Credit card benefits include

With the many benefits to owning a credit card, it makes financial sense to apply for your credit card today. Here are some of the benefits you can expect from your credit card.

- Legal protection not offered by debit cards or cash

- You are able to avoid interest if you pay off the balance in full and on time

- Credit cards are an effective way to improve a bad credit score and avoid bad credit loans

- A convenient payment method, which is accepted worldwide

Aqua Services

Competitive credit card facilities are our expert product service here at Aqua.

We offer credit cards to individuals with a less than perfect credit score, which is also designed to help rebuild credit ratings and help our customers regain financial strength.

Build your credit rating with aqua classic

- Start with a credit limit of £250 to £1,200 with the possibility of an increase after four credit card statements

- Free unlimited access to your credit report to keep up to date with your credit rating

- Payment reminders via text messages to ensure you never skip a payment

We help you manage your credit card balance

Aqua follows the ethics of a responsible lender and we have there for taken it upon us to help you manage your credit card balance and improve your credit rating. Here is how we help you manage your finances effectively.

- Reminders via text messages with regards to your payments and credit balance

- Flexible payment dates

- Friendly UK-based customer support line

- Online balance checking, payment facility and account management

- If you use your aqua credit card responsibly, make payments on time and staying within your credit limit, you could achieve a better credit rating

Aqua Product Details

- Loan Type Credit Cards

- Loan Amount from £250

Benefits of Aqua

- Flexible repayment dates

- Customer support line

- Apply with bad credit

Getting a credit card with Aqua could not be easier!

Apply online for your Aqua credit card today, even if you have a bad credit rating.

The minimum requirements to apply for one of our credit card facilities require you to be a UK resident over the age of 18. We will only recommend a credit card and card limit that we think you can afford as part of our responsible lending practices.

Other requirements

You will need either a UK bank or building society account. It is required that you have not been registered as bankrupt or have bankruptcy proceedings against you, haven't received a county court judgement in the last 12 months.

We look for reasons to say YES

Although subject to credit checks, an aqua card could be granted to individuals who,

- Are self employed and unable to prove a regular income

- Have been affected by a CCJ (other than in the past 12 months)

- Work part-time

- Are students

- Are new to credit

- Have not had a credit card in the UK before

- Have been turned down for a personal loan or alternative credit in the past

- Are on a lower income

Different benefits, different credit cards

Aqua Advance – customers are able to reduce their rate over three years should they stay within their credit limit and make repayments on time and there are no extra fees on what is spent abroad.

Aqua Reward – Get 0.5% Cashback (up to £100 per annum) and there are no extra fees on what you spend abroad.

Aqua Start – Receive a credit limit of £100 - £300 and enjoy UK based customer service that helps you build and rebuild your credit rating.

Customer Reviews & Testimonials

Aqua Contact Details

Physical Address

- Kings Cross London England GVPG+QM United Kingdom

- Get Directions

Opening Hours

- Monday 08:00 – 21:00

- Tuesday 08:00 – 21:00

- Wednesday 08:00 – 21:00

- Thursday 08:00 – 21:00

- Friday 08:00 – 21:00

- Saturday – Closed

- Sunday – Closed