TSB

Updated

- Credit Cards up to £1,200

- Low-interest starting from 19.95%

- Earn lower rates

In-page navigation

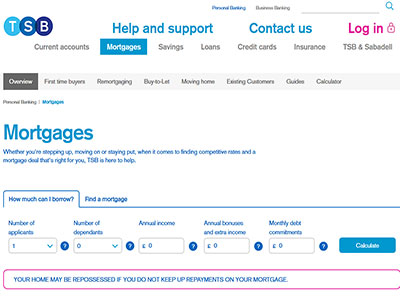

Author TSB. Screenshot of TSB website. [Accessed December 18, 2018]

About TSB

Created more than 200 years ago, TSB was built on the idea of local pride, and we believe in supporting local communities.

Serving our local communities

Our community responsibility and involvement range from child-based initiatives, to members of the armed forces and emergency services and local sporting heroes. As we operate our business in these communities, we believe it is our responsibility to serve the locals of these communities.

Providing credit cards to locals of the UK

TSB’s wide range of financial products and services are proudly provided to UK residents. One of these expert products include credit cards that are affordable, and is a credit facility that is designed to serve you and your credit requirements.

Best credit cards in UK

TSB is your answer if you are looking for the most competitive credit card package in the UK. We will be happy to help you get the credit card that best suits your lifestyle.

Highly recommended banking service

We hold a 5 Star rating by Defaqto and are Britain’s most recommended high street bank.

TSB Services

One of our popular choices is TSB's longest Balance Transfer Card. Let’s have a look at some of the features and benefits thereof.

What is the credit card good for?

- Shopping

0% interest on purchases for three months - Saving

0% interest for 28 months on balances transferred in the first 90 days - Transfer fee

0.50% balance transfer fee for the first 90 days. 0% balance transfer fee after refund. Terms and conditions apply - Limited offer

1% cashback on the first £500 of eligible spend each month when you have a TSB Classic Plus current account.

What do you get?

- You will get up to 56 days' interest-free period on purchases, provided that you pay your balance in full and on time each month.

- You are secured online by ClickSafe and our Internet fraud protection protects you from online fraud.

- The Money Planner is an innovative concept that helps you keep track of your money across your TSB personal current and credit card accounts.

There is a minimum balance transfer amount of £100 with a 0.50% balance transfer fee for the first 90 days. 0% balance transfer fee after refund.

TSB Product Details

- Loan Type Credit Cards

- Interest Rate from 19.95%

- Loan Amount up to £1,200

Benefits of TSB

- No interest for 3 months

- Balance transfers

- Competitive rates and fees

We offer financial products and services, designed with our customers in mind

Apply for a TSB credit card online by completing a quick online loan application form.

All you need is about five minutes to complete the form but before you do so, please ensure that you meet the minimum requirements. Terms and conditions apply to all TSB credit cards and full details will be sent with your card should your application be approved.

Minimum requirements

- You must be 18 years or over

- You must be a UK resident

- You must have a regular income

- You must not be currently declared bankrupt, have any County Court Judgments against you or be subject to an Individual Voluntary Agreement

Required information

- your bank account number and sort code

- residential address details for the last three years

- details of any balances to be transferred

Responsible lending

As TSB is a responsible lender, we will only borrow what you are able to afford. We will be happy to discuss your unique requirements and situation. You will be referred to a member of staff that will be able to help you. Should you be experiencing financial difficulties, they will also be able to assist you. Credit card approval depends on our assessment of your circumstances.

Information about balance transfers

The introductory balance transfer offer is only available to new TSB credit card customers. Ensure that you stay loyal to your repayments and stay within your credit limit to keep your promotional rate.

Credit card important information

There are a few important consideration regarding credit cards, these include,

- Credit limits will vary based on your individual circumstances.

- The approval of your credit card depends on our assessment of your circumstances and is only available to individual over the age of 18 and UK residents.

- You will only be eligible for any promotional rates if you stay within your credit limit and make your repayments on time each month.

- You will be charged at your standard rate after the end of the promotional rates period.

- Terms and conditions apply to all TSB credit cards benefits. Your card will be sent to you with all the information relating to your credit card and agreement.

TSB is a trusted & reliable provider of credit cards

In our review, TSB adheres to the compliance criteria in accordance with the Financial Conduct Authority, where the granting the loan will not cause financial distress to the consumer.

TSB is a registered credit provider in the UK; FCA number 191240

Customer Reviews & Testimonials

TSB Contact Details

Physical Address

- 176 Gorgie Rd Edinburgh England EH11 2NT United Kingdom

- Get Directions

Opening Hours

- Monday 09:30 – 16:30

- Tuesday 09:30 – 16:30

- Wednesday 09:30 – 16:30

- Thursday 09:30 – 16:30

- Friday 09:30 – 16:30

- Saturday – Closed

- Sunday – Closed