Satsuma Loans

Updated

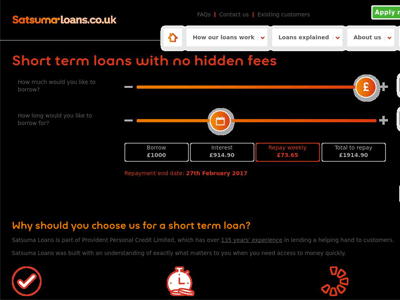

- Personal loans up to £1,000

- Low-interest starting from 133%

- Repayment up to 12 months

In-page navigation

Author Satsuma Loans. Screenshot of Satsuma Loans website. [Accessed May 11, 2020]

About Satsuma Loans

Many online lenders offer payday loans that need to be repaid by your next payday.

This can be a problem if you are already struggling to make ends meet and need to repay such a large amount in one lump sum, we are different because we understand that doing so is not always possible on could put you under worse financial strain than before.

Our loans give you the time that you need to repay them and allow you to choose to pay on weekly or monthly bases.

Earn the right to borrow more

First-time clients qualify to borrow £1000 and if you repay your short-term loan without any problems, the next time you will be able to borrow £2000 with very flexible and easy to manage repayment terms. There are no unexpected fees with us and our contracts are completely transparent.

Reasons to choose our loans:

- Very flexible instalments that can be paid weekly or monthly

- Easy to manage payment plan that gives you the time you need to repay your loan

- No hidden fees and obligation free quotes

Hold yourself responsible

As a responsible lender, we need to make sure that you are able to afford the payments on our online personal loan.

The better your credit score is the less your loan will cost you.

Apply online for a personal loan and see if you qualify without it affecting your credit score. Our short term online loans allow you to borrow up to £1,000. See if you qualify before you apply.

Satsuma Loans Services

The best thing about our online personal loans is the speed at which they can be acquired. For over 135 years we have been helping citizens in the UK when they need financial assistance.

Our system is designed to get the money you need very quickly. Complete a simple online loan application, receive your outcome, if your loan is approved then your loan will be paid into your account within 1 hour. Our loans are speedy so that you can get the cash you need as quickly as you need it.

Our smart check system

Our smart check system is what allows us to process your application so quickly our system will check and verify your information. This system uses a soft check approach so that it doesn’t damage your credit record.

Receive your result within 60 seconds and your payout within 1 hour.

Qualifying loan criteria for a Satsuma loan

- You need to supply a valid email address and mobile number

- You will need to supply address information from the past 3 years

- Proof of your incoming and outgoing financials

- A copy of your bank statement

You also need to be:

- Between the age of 18 and 74

- A resident of the UK

- You need to consent to a credit check

- You can’t be bankrupt

If you meet these lending criteria you are more than welcome to apply for a quick loan and see if you qualify.

Satsuma Loans Product Details

- Loan Type Personal loans

- Interest Rate from 133%

- Loan Amount up to £1,000

- Repayment 30 days to 12 months

Benefits of Satsuma Loans

- A dedicated customer service team

- Flexible repayment structures

Affordable and reliable loans at your fingertips

To help you make better financial decisions and to better track, you’re spending we will send you a borrowing summary.

This summary will keep track of how much you have paid on your loan, the fees you have been charged and if you have missed any payments. This will help you see a clear picture and track your spending and payment habits for up to 12 months.

Your credit score can lower the cost of your loan

Those with a good credit score are rewarded with a lower interest rate and more favourable loan terms. Those with bad credit can still apply for a bad credit loan but they may be charged a higher interest.

To make sure that your credit score remains high follow these simple tips:

- Never miss payments on a loan

- Always pay your bills on time and pay as much as you can on instalments each month

- Don’t have a lot of inactive credit cards as they can have a negative impact on your credit score

6 steps too success

Applying for one of our online loans is so simple. Log onto our website and follow the 6 easy steps to apply for your loan.

- Use the helpful online calculator to determine the type of loan you need and the amount of money you would like to borrow

- Enter your details into the system and Smart check will see if you qualify for a loan and let you know exactly how much your loan will cost you

- We will verify your details and if your personal loan is approved the money will be paid into your account within 1 hour

- Download our app to track your loan and manage your payments more easily

- Chose how you would like to pay us back weekly or monthly and there are no penalties charged for paying back your loan early

- Talk to us, we are there to help you call our customer care line should you require any assistance

Satsuma Loans is a trusted & reliable provider of personal loans

In our review, Satsuma Loans adheres to the compliance criteria in accordance with the Financial Conduct Authority, where the granting the loan will not cause financial distress to the consumer.

Satsuma Loans is a registered credit provider in the UK; FCA number 700144

Customer Reviews & Testimonials

Satsuma Loans Contact Details

Contact Number

Website

- not available

Physical Address

- 1 Godwin St Bradford England BD1 2SU United Kingdom

- Get Directions

Opening Hours

- not available