Tesco Bank

Updated

- Property Finance up to £35,000

- Low-interest starting from 2.9%

- Repayment up to 3 years

In-page navigation

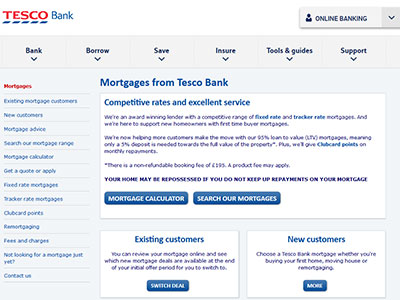

Author Tesco Bank. Screenshot of Tesco Bank website. [Accessed December 18, 2018]

About Tesco Bank

Initially launched as a credit card provider in 1997, Tesco Bank now has about 7.6 million customer accounts across a range of retail banking and insurance products, including mortgage loans.

Various home loans are available, offering the very best home loan packages in the industry.

Our core values are ease, value and trust. These are the values our customers desire in a home loan lender, and we understand this.

Clear and simple business practices

The core purpose of Tesco is a clear and simple statement of what we do and what we stand for and that is to serve Britain residents with the most competitive home loan packages available in the industry.

Fixed rate and tracker rate mortgage

From fixed rate mortgages to tracker rate mortgages and home improvement personal loans, we aim to offer all the home loans you might need. Contact us today to secure the most affordable home loan.

Excellent customer service

Delivering excellent customer service is at the core of our business model, our call centres in Glasgow, Edinburgh and Newcastle are open seven days a week for your convenience.

Customer rewards

Tesco Bank believes in the value of rewarding loyal customers choose who use our products and we do this by rewarding Clubcard points to customers.

Tesco Bank Services

On offer, we have a range of mortgage deals suited to your individual requirements.

Our award-winning range of fixed rate and tracker mortgages with competitive rates are sure to guarantee that you get the best home loan deal available.

Various mortgage services available

Whether you're a first-time buyer, moving home or looking to remortgage, we are the right choice for you. You can collect Clubcard points on your monthly repayments, which is just another reason why we are a preferred home loan lender.

Fixed rate mortgage

If you would prefer to know exactly what you repayments will be for a predetermined repayment period, our fixed rate mortgage loans are for you. We have two, three and five year fixed rate mortgages, which will ensure you repay an unchanged repayment amount each time.

Tracker rate mortgage

We also offer a two year tracker rate mortgage, which can provide lower monthly repayments. However, those payments will change if the tracked rate changes.

Home improvement loans

Whether you are building an extension or renovating your kitchen, and in the process add more value to your house, we are here to assist you.

What are our home loans used for?

Our loans are used for anything from home improvements, garden makeovers, exterior improvement, additions and more.

Tesco Bank Product Details

- Loan Type Property Finance

- Interest Rate from 2.9%

- Loan Amount up to £35,000

- Repayment 1 year to 3 years

Benefits of Tesco Bank

- A convenient online loan calculator

- Flexible repayment options and terms

- A low-interest rate starting at 2.9%

- No early settlement charges

We will offer you the perfect loan to suit your requirements

Apply online or contact one of our mortgage experts to get the home loans you require today.

Before applying for a loan, there are a few things you need to know,

Minimum requirements to apply for a home loan

- Your annual household income is more than £20,000

- You have a good credit history

- You are a permanent UK resident and/or have right to remain in the UK

- You are over 18 years of age

- You are required to not be older than 75 years of age when your mortgage ends

Why choose a Tesco Bank mortgage?

- Clubcard points on your mortgage repayments

- Make overpayments up to 20% each year

- Fixed and tracker rate mortgages

Required documents

- Details of the property

- Your financial monthly expenditure

- If you’re remortgaging, we will need to know the details of your current mortgage

The following guides are available to guide you through the process

- Your document guide

- General information about our mortgages

- Income and expenditure

- Accountant's certificate

Apply via one of our experts or online

Should you wish for a traditional, personal approach to your home loan, one of our qualified mortgage advisers can recommend a mortgage product that best suits your requirements. However, you also have the option of applying online. It saves time and streamlines the lending process further. Either way, we will assist you every step of the way.

One of the best UK mortgage lenders

Recognition for our range of mortgage products proves our dedication to offering the very best home loans available. Awarded the Moneyfacts Best First Time Buyer Mortgage Provider 2016 and named Moneynet's 'Best Direct Mortgage Provider' for the third time is what sets us apart from other lenders.

Customer Reviews & Testimonials

Tesco Bank Contact Details

Physical Address

- Bradley Stoke Bristol England BS32 8EJ United Kingdom

- Get Directions

Postal Address

- PO Box 353, Darlington, DL1 9QR, UK

Opening Hours

- not available