Provident

Updated

- Short-term Loans up to £1,000

- Low-interest starting from 112%

- Repayment up to 52 weeks

In-page navigation

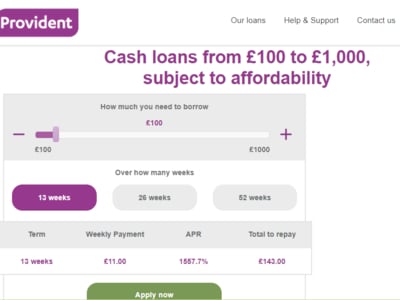

Author Provident. Screenshot of Provident website. [Accessed May 12, 2020]

About Provident

Provident Financial is one of the leading providers of personal credit products in the UK lending market.

On offer, we have a number of products including home loans, credit cards through Vanquis Bank and online loans through Satsuma Loans. We guarantee to offer you the most comprehensive financial products in the industry.

We value our customers

Our customers are at the heart of our business since our establishment in 1880.

Provident offer cash loans between £100 and £1,000, which can be repaid over a range of terms and is also subject to affordability.

The personalised service we offer is like no other in the industry and we are continuously striving to enhance our services and products because we value our customers.

Our community responsibility

Provident is committed to helping people within our communities.

Not only do we provide much needed loan services but we also support and serve our communities. Our community programme aims to benefit those who live and work in the areas, in which we operate.

In 2015 we assisted 37 organisations across the UK. In 2016, we launched another exciting innovation, in which we allowed you to suggest charities that required support in the UK.

We also have a dedicated newsroom that keeps you up to date, every step of the way.

Provident Services

Available are short term loans from £100 to £1,000, which is subject to affordability.

Our repayment terms are flexible and allow you to choose the best option to suit you.

What are short term loans?

Short term loans are designed to alleviate short term money difficulties. It allows you quick access to the funds you require, in the shortest time possible without extensive loan procedures.

Provident short term loan benefits

- FIXED weekly payments collected from your home

- NO hidden fees for late or missed payments

- CASH delivered to your door

- FACE-TO-FACE service

Loan amounts available

The amount you are able to borrow depends on a number of factors such as your income, expenses and whether you are able to afford the loan repayments. The above information forms part of the application process. One of our team members will then visit you at your home to discuss your loan requirements.

Unsecured short term loans

We offer unsecured loans, which means you are not required to put forward any assets or property as collateral. The loan amounts available range between £100 and £1,000 over a repayment period of 13 to 52 weeks.

All-purpose loans

Do you have an unexpected bill or an unforeseen breakdown? Use our short term loans for whatever you need to. What you use the loan for does not form part of the lending criteria.

Provident Product Details

- Loan Type Short-term Loans

- Interest Rate from 112%

- Loan Amount up to £1,000

- Repayment 13 weeks to 52 weeks

Benefits of Provident

- Flexible repayment options up to 52 weeks

- Bad credit loan options

- A transparent service

Provident's short-term loans are easy & hassle-free

We aim to assist as many people as possible to get funds that they might require urgently.

Our service is unique and customer-centred, guaranteeing the best lending experience for you.

Online application

To start the online application you would need to provide the following:

- Your personal information including your name and date of birth

- Your address details for the past three years

- A contact telephone number and email address

Loan affordability

During our visit we will perform an affordability assessment, which is why we require you to provide your proof of income and expenses. Should you not be able to afford the amount you have applied for, you may be offered a lower loan amount that does suit your affordability.

Application process

1. Choose your loan option

The online calculator enables you to select how much you need to borrow as well as the repayment period. You have the option of 13, 26 or 52 weeks to make repayments.

2. Start your loan application online

To apply for a Provident loan you are required to,

- Be a UK resident, aged between 18 and 74

- Have a contact telephone number

- Address details for the past three years

- Agree to a home visit from one of our team members and an affordability assessment

3. Finish your application with a home visit

You will have provisional approval within minutes and the loan application will then be finalised by one of our team members after you a home visit to assess affordability.

What do I need for the home visit?

- Proof of ID and address

- Proof of income

Accepted proof of income

- Payslip from your employer

- Statement of earnings

- Child benefit

Accepted proof of identification

- Current photo card driving licence

- Current signed passport

- Utility bill dated within the last six months

Repaying your Provident short term loan

Upon loan approval, one of our team members will collect the repayment amount on a weekly basis. This will be done on a date and time that suits you, and it keeps your loan repayments as simple as possible.

Customer Reviews & Testimonials

Provident Contact Details

Physical Address

- 1 Godwin St Bradford England BD1 2SU United Kingdom

- Get Directions

Postal Address

- Customer Relations, Provident 1 Godwin Street, Bradford, BD1 2SU, UK

Opening Hours

- Monday Open – 24 Hours

- Tuesday Open – 24 Hours

- Wednesday Open – 24 Hours

- Thursday Open – 24 Hours

- Friday Open – 24 Hours

- Saturday Open – 24 Hours

- Sunday Open – 24 Hours