Funding Circle

Updated

- Peer-to-Peer Lending up to £350,000

- Low-interest starting from 4.9%

- Repayment up to 60 months

In-page navigation

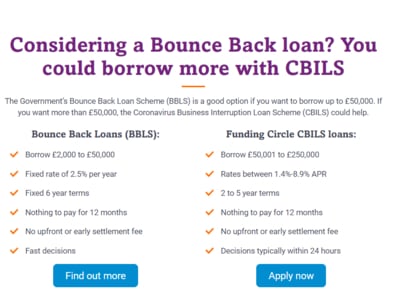

Author Funding Circle. Screenshot of Funding Circle website. [Accessed May 14, 2020]

About Funding Circle

What the Funding Circle has done is revolutionise a broken system that saw businesses and investors like not have a platform that offered mutual benefits.

Our establishment is a direct result of businesses that did not have access to the business finance they needed in order to grow, while investors were making poor returns. So our idea is quite simple— let them support each other and reap richer rewards.

Better returns, better business financing

Through the Funding Circle platform, investors earn attractive returns and businesses get fast, easy access to funding to grow, create jobs and support local communities. We believe it is better, fairer for everyone.

Strong growth

The point is when small businesses succeed, it benefits everyone and up to date 80,000 jobs have been created directly and indirectly through our innovative form of peer-to-peer lending. Additionally, £3 billion has been lent to businesses globally.

Let us help you grow financially

We are here to assist you whether you are a business owner who needs financing, or an investor who wants to see your money grow. In fact, it is because of our stakeholders that we built Funding Circle for.

What else have we achieved?

Not only have we helped 32,000 small businesses across the world but more importantly, we have helped thousands of businesses in the UK, US, Germany and the Netherlands grow and reach new heights. If that is not enough, every £1 lent to businesses in the UK, adds £2 to the economy.

Finance for almost any purpose

Established businesses of all sizes have been able to take their next step with financing for any purpose. Let us know if you can assist you with your online loan application to take the next step in your business.

Funding Circle Services

Investors and borrowers are at the heart of the service we offer.

We provide the platform that enables these stakeholders to borrow and invest without a traditional banking institution. This is how we ensure the best rates in the business.

Investors reap rewards

A staggering 69,000 investors are earning for their future and reaping the rewards of our peer to peer lending platform. Our peer-to-peer loans are funded by thousands of people, local and national governments and financial institutions, who have lent over £3 billion.

Build you business

If you have been wanting to expand, hire staff, boost cash flow or fund the next step of your business, we can make that happen for you.

What do our loans offer?

- Unsecured loans from £5k to £350k

- Borrow over six months to five years

- Rates from 4.9% per year

- Get a decision typically in 24 hrs

- No early repayment fees

Secure the future of your business

All you have to do is complete a quick application and a dedicated account manager will provide you with a fast online loan decision. Take your business to new heights today and secure your future with an affordable business loan.

Proven track record

A massive number of about 26,000 UK businesses financed their business goals by borrowing £2.5 billion through the Funding Circle platform.

Thousands of investors/lenders

All our quick approval loans are funded by thousands of investors, which include 63,000 people, local government and other institutions. All these investors have one thing in common; they want to invest their money in British businesses like yours.

Trusted by businesses and investors

Our expert speciality is that of business lending and as a result, we are trusted by both businesses and investors. We have tailored our award-winning service to give you an optimal customer experience.

Funding Circle Product Details

- Loan Type Peer-to-Peer Lending

- Interest Rate from 4.9%

- Loan Amount up to £350,000

- Repayment 6 months to 60 months

Benefits of Funding Circle

- Small business loans

- Repay your loan early without penalties

- Apply online in 10 minutes

We guarantee better returns, and better business financing

It is quick and easy to apply with our simple online form.

You are able to see if you qualify in 30 seconds. Thereafter, tell us about you and your business in our 10-minute form to receive your instant quote.

You are then advised to review the repayment options and pick the best for you. You will receive a decision in 24 hours and if approved, you will get a long or short-term loan offer typically in 24 hours. The loan offer that you choose to accept will be deposited in your account within a few days.

Fixed, affordable monthly payments for businesses

Businesses are able to borrow from £5,000 to £350,000 and repay the loan amount from six months to five years. We do not charge any early repayment fees, which is a method of saving money on interest.

Quick facts

- Our rates start from 4.9% per year for borrowers and earn a projected return of 6.7% per year as the investor

- Your actual return may be higher or lower and your capital is at risk

- Proven track record over seven years

- Lend easily with automatic tools and innovative technology

- Early access to money options

- Investors have access to 100s of British businesses available to lend to

- A proven track record of stable returns

How lending works

The Funding Circle is a peer to peer loan platform that enables you, as the investor, to lend directly to established small British businesses. It is a win-win as they get the financing they require to grow, and you can earn lucrative returns via monthly repayments from borrowers.

- Simple to use at every step

Use our easy-to-use online account, automatic tools and investor support that makes earning profitable and stable returns quick and simple.

- Open your online account

It will only take a few minutes to set up your account and transfer money from your bank.

- Start lending automatically

Investors use the Autobid tool to lend small amounts to hundreds of businesses automatically.

- Receive monthly repayments

Investors typically receive repayments with interest each month from the businesses that holds their investment portion.

- Repayments are reinvested

Reinvest your repayments with Autobid, which will lend out your repayments again to help maximise your earnings.

Funding Circle is a trusted & reliable provider of peer-to-peer lending

In our review, Funding Circle adheres to the compliance criteria in accordance with the Financial Conduct Authority, where the granting the loan will not cause financial distress to the consumer.

Funding Circle is a registered credit provider in the UK; FCA number 722513

Customer Reviews & Testimonials

Funding Circle Contact Details

Physical Address

- 71 Queen Victoria St London England EC4V 4AY United Kingdom

- Get Directions

Postal Address

- 71 Queen Victoria St, London, EC4V 4AY, UK

Opening Hours

- Monday 09:00 – 18:00

- Tuesday 09:00 – 18:00

- Wednesday 09:00 – 18:00

- Thursday 09:00 – 18:00

- Friday 09:00 – 18:00

- Saturday – Closed

- Sunday – Closed