Help in navigating the complex vehicle finance options available to you

Buying a vehicle is an exciting time, and you will no doubt have more car loan options than you could possibly imagine. The trick is to find a car loan that works for you!

With such a variety of car loan lenders to choose from, it becomes increasingly important to know what the best car financing option would be for you. It is what will determine the difference between preferable interest rates, additional charges, features and benefits.

To find a lender is not hard; but when it comes to choosing the perfect fit, we are there to help you!

Why you should choose pre-approval on a car loan

A pre-approved car loan gives you buying power. It enables you to know your exact budget and can often ensure a better deal from a car dealership. Additionally, it gives you negotiating power, which ensures you are getting your money’s worth when purchasing a vehicle.

When it comes to choosing the type of lender you would prefer, we present you with all the options available. From credit unions to high street banks, and other alternative lenders, you will find a lender that has the best available car loan deal.

Top reasons for pre-approved car loans

- Have an exact budget to smooth out the buying process

- Improved bargaining power at the car dealership

- Ensure the purchase goes through without unexpected delays

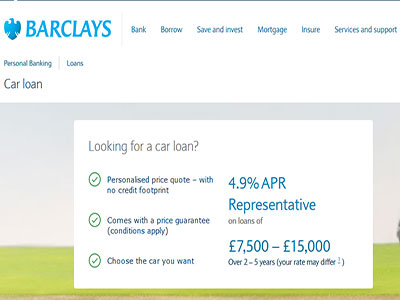

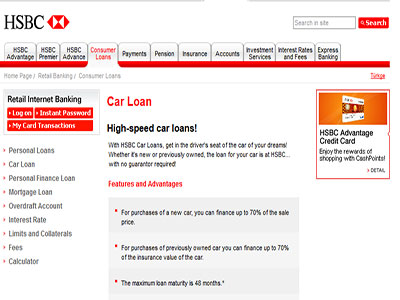

Comparing different car loans

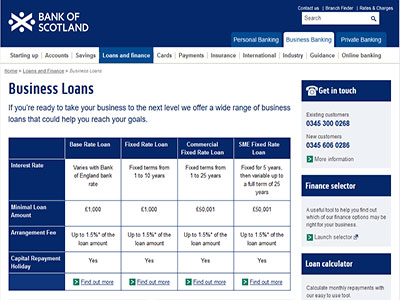

Purchasing a vehicle is far too important to simply accept the first offer you receive. It is recommended that you compare at least three car loan options before making a final decision.

The best way to do this is to conduct research so that you know what your options are. Although there are many online lenders who will let you apply for a loan online through a variety of portals you may also want to visit your local bank or a local cardealership to speak to a consultant. It simply allows you to know that you are getting a car loan that works for you!

Regardless of whether you have bad credit or your income type, and other factors, you should be able to find a car deal that caters for your personal circumstances. Consumers are encouraged to compare the interest rate, and importantly, the loan term of the car loan before applying with a car loan provider.

Financing for different types of vehicles

Perhaps you already have the car of your dreams and you have been looking at purchasing a more lavish type of vehicle such as a boat, motor home, or other. Our listed online lenders have vehicle loans to suit any type of vehicle you wish to purchase. We help you find a lender that is willing to make any vehicle purchase, a reality.

To lease or to own?

PCP (Personal Contract Purchase) practically allows you to get a brand new car at the end of the term or to fully purchase, and own the car at the end of the term. It is car financing that allows for greater flexibility when purchasing a vehicle.

Personal Contract Hire leasing (PCH) requires consumers to pay an initial deposit followed by monthly payments. The core difference is that you effectively rent the car, and do not have the option to fully own the car. At the end of the term, the car is returned.

Leasing pros

- Leasing is a cost effective way to drive a brand new car

- Affordable, fixed monthly payments

- Lower deposit than PCP deals, lender dependent

- Road tax and roadside assistance included

- Servicing and maintenance are optional that can be included

Leasing cons

- No option to own the car as it is on a rent only basis

- Somewhat lacks the flexibility of PCP

- There are strict mileage limits and wear and tear charges that apply

- Other more specific terms and conditions may apply

The real benefit of leasing

It is the cheapest financing option to drive a brand new car. The deposit requirement is often much lower with low, fixed monthly payments. It is an option for individuals looking for an all-inclusive car loan deal that could include features such as maintenance plans to insurance and road tax. Some lenders might even throw in a few free products and services, depending on your choice of lender.

PCP offers greater flexibility and large discounts

Although leasing is a viable car financing option, there are other things to consider. There are top PCP deals that offer similar – perhaps even lower – monthly payments, with low APR rates, and possible added dealer benefits.

These are the very reasons why it is important for you to know what options are available to you. Buying a car in an exciting time of your life but it is also one of the biggest purchases you will undertake. Thus, you need to ensure you make a sound choice. It is our purpose to provide you with all the essential information to help you make the best possible car loan choice to suit your needs. Dealership finance is not the only way to go and you may want to investigate alternative options such as personal loans and peer-to-peer lending platforms.

Other important car loan considerations

Firstly, you need to ensure that you are able to afford the monthly repayment. Before choosing a lender, you must comprehensively compare the total cost of borrowing, including all other related charges. Beware of early repayment or other charges, and ensure you fully understand your loan agreement. Bad credit loans used for buying a vehicle will always cost more than ordinary loans.

Compare interest rates by looking at the APR (annual percentage rate) and keep in mind that a higher deposit will normally mean a lower interest rate. You should also ensure you choose the best and most comprehensive insurance cover that you can afford.

If you have savings available, this could greatly benefit you when buying a car, but even if you have a bad credit rating, there are alternative financing methods to buy a car.

Top 10 tips for buying a car

- Ensure that you have done extensive research on both buying a car and financing options

- Always create a budget, and stay within that budget

- Additional fees such as registration fee, stamp duty, delivery fees and car insurance are to be taken into account

- Use a comparison rate to compare loans to narrow your search to the best options available

- Make use of a loan comparison website to compare specific deals and essential information on each lender

- Always get pre-approval to increase your buying power

- Negotiate with dealers for a better price every time

- Research cars and always have it inspect professionally, and consider all your options before closing a car deal

- Avoid falling for additional services and products that you have not budgeted for

- Ensure you have copies of all paperwork and read the car loan agreement carefully before you sign