Get a payday loan online in just minutes with these top UK lenders

A payday loan is, as the name suggests, a loan that is usually repaid upon receiving your next salary or wages. It typically offers lower loan amounts and can be obtained online in just minutes. Payday loans are ideal for emergency situations, in which you need a quick cash loan, fast.

Payday loans in a nutshell

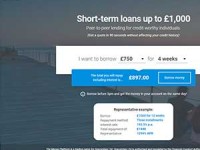

Although it is generally accepted, that a payday loan has a short repayment period, there are lenders that offer extended repayment periods, with multiple instalment repayments. Due to the nature of a payday loan, it is considered the most expensive loan form. However, it is the perfect solution if you urgently need cash, and payday is still a few days away.

A payday loan allows you to confidently take care of any expense, and it alleviates the stress that comes with unexpected expenses, especially if your emergency is of a serious nature such as medical expenses or car repairs.

Top advantages of a payday loan

- You can apply for a loan by completing an online loan application. It saves you time and offers the most convenience for consumers

- You are able apply from virtually anywhere using a computer, mobile or tablet device. Additionally, you can apply when you have time, instead of during limiting office hours

- You can have the loan credited to your account of the same day. Some lenders are able to transfer your approved loans within hours

- If you need a smaller loan amount, it is a viable option as many banks and traditional lenders do not offer such low loan amounts

- The loan term is usually 30 to 40 days, which helps you not to incur long term debt

- Your fast loan repayment or repayments are deducted automatically on your payday, making repayment of the loan as easy as possible

- Most lenders allow existing customers can apply for an instant loan easier, and quicker.

What you need to know about payday loans

- Payday loans carry higher interest rates than other forms of borrowing such as personal loans

- Fast loans are not suitable for debt consolidation

- They are unsecured and lenders usually offer only small amounts of cash, which will also be determined by your respective salary or income

- They are not suitable for long term use or to substitute additional income

- Fast loans are best for emergency purposes when you are in need of extra cash to see you through until your next payday

Find a payday loan

Alternative and online lenders are the most commonly used providers of fast loans. Due to the loan amount, and quick repayment of the loan, the entire process can be done online, and without lengthy application procedures and heaps of paperwork. As an existing customer of a payday lender, it is often easier to reapply for a payday loan once your existing loan has been repaid in full.

Do you qualify for a payday loan?

Payday loans are the easiest and quickest loan type to apply for. As long as you can prove that you are earning an income that is deposited into your bank account, you have crossed the biggest hurdle. Other basic requirements are that only UK residents and permanent residents of the UK can apply. Additionally, you are required to be over the age of 18, and you will be required to provide an acceptable form of identification to support your loan application.

With these requirements, almost anybody is able to apply for a payday loan. It is important to note that if you are having serious financial problems and you can forsee that you will be unable to repay the loan on time you should always look at alternative ways to get a loan as it may worsen your financial situation. For more financial information and tips visit our blog.

How long will you wait for you loan approval?

Payday lenders usually have the quickest turnaround time on loans, and you can expect to have your loan approved and transferred between one hour and 24 hours. More often than not, a payday loan will be finalised and paid over on the same day. If you have to wait more than 48 hours for a payday loan, we suggest you continue your search as waiting long for a payday loan defeats its main purpose, which is to be paid out in the shortest time possible.

Look for a lender that guarantees a same day loan transfer to make sure you get your loan in your bank account as soon as possible. Most online lenders offer a handy automated pre-approval feature, which enables you to know, within minutes, if you qualify for a payday or short-term loan.

Finding a reputable lender

Using our loan comparison website will ensure that you are dealing with a reliable and reputable lender. We only have the most trusted, reputable lenders on our platform, which allows you to safeguard against any underhanded lenders, and to find the best payday loan in the UK.

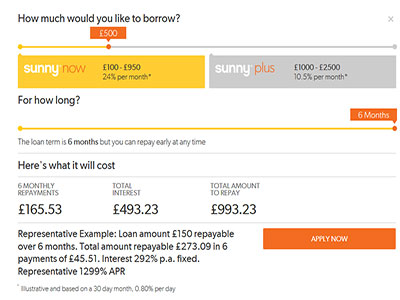

It is important to note that before agreeing to the loan, you should ensure you are fully aware of the interest rates, fees and any other additional charges to your payday loan. Some lenders have minimal fees compared to other lenders. Our loan comparison site allows you to easily view all the essential information on each payday lender available.

Guidelines when choosing a payday lender

Convenience is key when applying for a loan and thus, a lender that offers an online loan application is often preferable when you need cash fast.

- Does the lender offer the range of loan amount that you require? Ensure that you find a lender that offers the personal loan amount you need.

- How reliable is the lender? By using our comprehensive comparison site, you are able to eliminate the chances of choosing an unreliable lender.

- What are the loan processing times? Payday loans are usually used for emergency situation and you should therefore choose a lender that does not take more than 24 hours to process, approve and transfer your payday loan.

Uses for a payday loan

Payday loans are the ideal financial solution for unexpected expenses such as car repair bills, school fees, doctor bills, and more and can even be available to people who are blacklisted in the form of a bad credit loan. However, it also has more leisure-like purposes such as travel expenses and holidays. As long as you can afford to pay the loan back in the agreed time, a payday loan serves many purposes.