Credit cards that meet your lifestyle, spending & budget needs

A credit card also gives consumers the safety and convenience of using one card for a variety of purposes.

Credit card types, benefits, features and more vary significantly, and the best suited option for you will largely depend on your lifestyle, spending habits and monthly budget.

Credit card basics

The repayment arrangement is typically within a 30 to 45 day period without having to pay interest on that purchase. You have to repay the outstanding balance plus interest after such a period, the revert rate will depend on, and be agreed upon by your chosen credit card provider.

Essentially a credit card can act as a fast loan as you borrow money when you need it without having to pay interest on that amount within a certain period. Making the minimum payment required per given period will enable you to keep the interest free period going.

If you want to buy expensive items or airline tickets, credit cards are a viable solution. It gives you the means to pay for these large purchases in instalments, making it more affordable for you.

Range of top-notch services

Credit cards also offer a host of different services including, rewards and benefits such as fraud protection, free travel insurance, complimentary flights and reduced membership fees for a variety of different clubs and many more varieties. You can rent a car, hotel and access services, which require a deposit to be retained without any hassle with a credit card. A credit card also gives consumers the safety and convenience of using one card for a variety of purposes. You can easily and quickly apply for a credit card by completing an online loan application.

Types of credit cards

Rewards credit cards

A popular choice among travellers and offer customers everything from frequent flyer to voyager miles and maximum rewards or cash backs for the things that are best suited to your lifestyle.

0% Interest cards

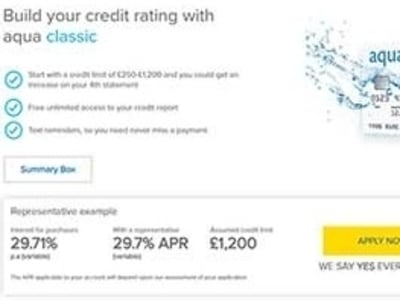

A viable choice for new applicants who are interested in the interest free purchases as you will get a very low or a 0% interest for a period ranging from 55 days to 12 months. Always consider the interest rate that it will revert to after this interest free period when choosing this option.

Credit cards with low interest

If you are looking for a credit card with a below average interest rate, this might be the best option for you. It allows you to carry a balance over on their credit card. Typically these credit cards carry annual fees.

Balance transfer credit cards

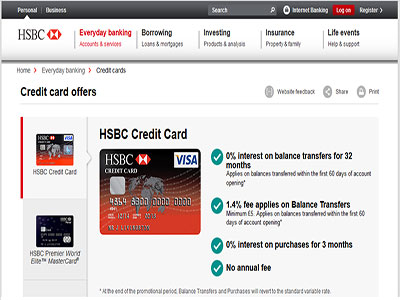

This is a credit card that cuts out interest and as balance transfer cards allow holders to transfer balances from other credit cards with interest free periods that go all the way up to 24 months. Once more, it is important to compare the revert rate before signing a credit card agreement.

Credit cards with no annual fees

This type of credit card does not have any annual fees or very little and, since you repay your credit card balance in full. You as a result do not incur interest rate fees.

Foreign currency or travel credit cards

If you are planning a trip and do not want to spend large amounts on currency conversion fees, this type of credit card is your best bet. It enables consumers to load credit and use credit up to your set limit in a foreign currency. The result is that they do not get charged every single time they draw money or use cash while overseas or on holiday.

What to consider

It is important to consider all the essential information when you want to apply for a credit card. Everything from card fees, interest rates, introductory periods and insurance are some of the essential things to consider. Although some people use credit cards to purchase a car, it is always advisable to investigate various vehicle loans as these may be cheaper in the long run.

Here is a checklist of things to consider

- A preferred credit card scheme such as American Express, MasterCard or VISA

- Any introductory offers such as the 0% interest on purchases or balance transfers

- Interest rate and/or revert rates

- Annual fees

- Currency conversion rates

- Cash advance interest rate

- Insurance services offered

- Rewards offered

- Late payment penalties

Where you can get a credit card?

American Express, Visa, MasterCard and Diners Club are the biggest names in the credit card industry. You can also apply for a credit card available through major banks, credit unions, alternative credit providers and more. All lenders offer a range of credit cards from their low rate variety to the maximum reward cards. The best option for you should suits your lifestyle and needs simultaneously.

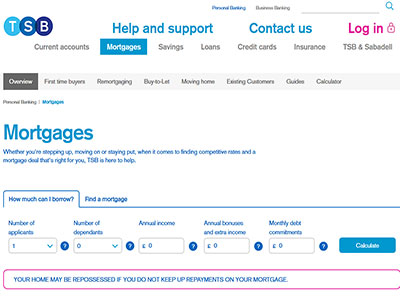

Qualifying for a credit card

It is not as easy to qualify for a credit cards compared to personal loans, payday loans, quick loans and more. You will be required to have a good, clear credit history and to earn above the lenders set minimum. Additionally, you will be required to demonstrate that you are not over indebted. Generally speaking you must have a clear credit history and you must be 18 or over, be a citizen or permanent resident of the United Kingdom and be permanently employed or self-employed on a full-time basis.

How to choose a credit card

Choosing a credit card with all the various options available on the market is not always the easiest task. Your lifestyle and purchase choices will largely determine the best credit card option for you. It is important to understand the features and benefits of all the different types of credit cards before choosing, and applying for a credit card. There are many online loan and credit card comparison websites which can help you compare and choose the best credit card for your needs.

Understanding 0% interest & 0% balance transfer cards

Credit card providers use their 0% interest on purchases and 0% interest on balance transfers offers as a major selling point. As a result, it is important that you understand what terms come along with the 0% interest periods. The 0% interest will only be valid for a set period of time and depends on the provider. Some credit card providers offer 55 days interest free periods while some may offer it for up to six months. Thereafter, the credit card will incur an interest charge as specified in your contract.