Personal loan features & benefits that you’ll love

Personal loans allow you to use the financing for a wide variety of purposes. It is also the most commonly applied for loan type, which does not only offer great flexibility but also a range of features, and benefits.

Find an expert lender

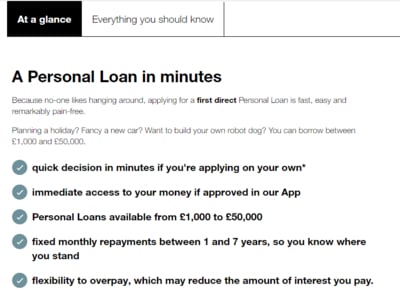

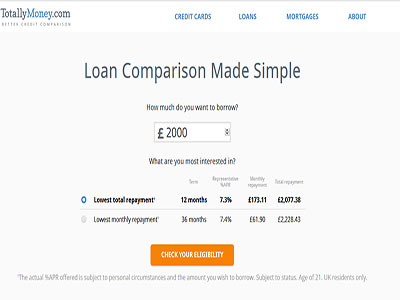

Through our platform, customers gain access to a range of financial services providers including banks, peer-to-peer lenders, credit unions and online credit providers to name a few. Most of the lenders on our platform offer online loan applications with turnaround times from one hour to seven days, to process the application, and get your loan approved.

You now have access to the most important information on some of the best lenders in the UK. The purpose of our platform is to equip you with the necessary facts and knowledge to make an informed decision when you want to apply for a personal loan.

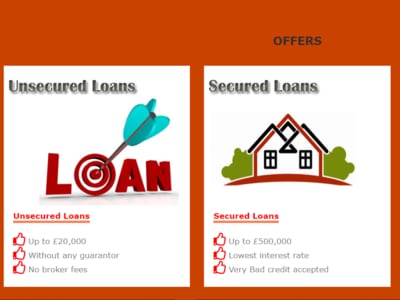

Two main types of personal loans

Secured loans are secured by your asset/s, in case of payment default. Home loans and vehicle loans are other examples of secured loans as you secure the loan against the home or vehicle you are purchasing. Most bad credit loans also require applicants to secure their loans against a valuable asset/s. Often times a secured loans offer the best interest rates as the borrower as increased security to ensure the full payment of the loan.

Unsecured loans consequently have higher interest rates but do not require any form of security. If you have a good credit score you can easily apply for an unsecured loan at most banks and other credit providers.

Choosing a personal loan provider

The first and most important consideration is that you choose a loan provider that meets your particular needs more precisely, without compromising on what is important to you.

Generally, banks are the first lender that consumers approach. Although banks are thought to offer the most competitive personal loan products, including flexible loan terms and low interest rates, many other lenders cater for individuals with special loan requirements as in the case of bad credit loans and faster turnaround times as in the case of payday loans.

Some people seeking a personal loan might benefit mostly from an alternative credit provider such as a peer-to-peer lender or an online lender. That is where we come in. With all the information available to you, you are able to make the best decision when choosing a lender.

Important to help you choose the best personal loan lender

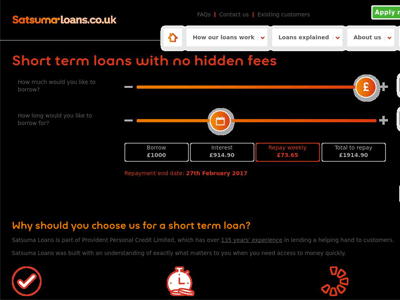

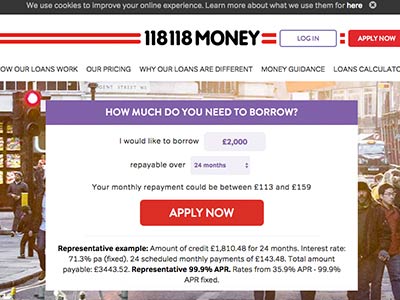

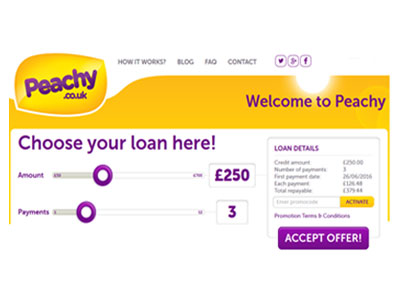

Customers are encouraged to take the interest rate of a personal loan into consideration. However, it is important to keep in mind that the interest rate displayed does not include any other additional costs that may apply.

For a true representation of the loan costs you must look at the Annual Percentage Rate (APR). This percentage will include the interest on the personal loan as well as any other fees that will apply over the term of your loan. Early repayment is a feature that can save you money on interest. Some lenders charge early repayment fees, and others do not. It is yet another feature to look out for when choosing your preferred lender. The same goes for late repayment, it is advisable to know the late repayment rates of the lender you are considering.

Do you qualify for a personal loan?

The lending criteria will vary greatly depending on a specific lender, and the particular type of personal loan that you apply for. Generally, there are a few minimum requirements, such as that you are required to be a UK citizen or permanent resident, over the age of 18, earning a stable income. Lenders might also request information such as your monthly budget and some supporting documents.

Our platform makes it easy to view the requirements of the lenders we have listed on our platform.

Different lending approaches

While most lenders offer a convenient online loan application, there are lenders that offer customers a more personalised, face-to-face approach that allows customers to meet with a loan consultant. Some lenders only offer online application. However, there is a loan application method to suit all applicants. We have set up a platform that simply makes it as easy as possible for you to find a lender that ticks all your requirements.

Benefits of personal loans

- A personal loan is easy to budget for, and thus allows you to stay ahead with your finances.

- Most personal loans are offered over a fixed interest rate, ensuring your monthly repayment does not change.

- There are fixed repayment terms, which allow you to know exactly when your loan will be repaid.

- With longer repayment terms available, you have the flexibility to fit your monthly repayment into your budget, comfortably.

- As you make monthly principal payments, the outstanding loan steadily decreases over the duration of the repayment term.

- A personal loan is a multi-purpose loan that gives you the freedom to spend the money as you wish. In other words, the loan is not purpose specific such as a car loan, for example. From weddings to your child's education, renovating your home or even paying back an existing loan, the option is yours.

- You can apply for an unsecured personal loan, which does not require any collateral to secure the loan.

- Compared to other types of loans, personal loans require minimal paperwork, and processing times.

Useful questions to ask when applying for a personal loan

In a nutshell, when you want to apply for a personal loan, you should ask the following questions to guide you in the right direction, of which option would best suit your unique and specific requirements.

- How much do I need to borrow?

- Am I applying for a secured or unsecured loan?

- Would I benefit most from a variable or fixed interest rate?

- Which online lenders offer what I need?

- What is the interest rate?

- Can I repay my loan early with no early repayment fees?

- What additional fees will I be charged?