Short-term loans can be either secured or unsecured

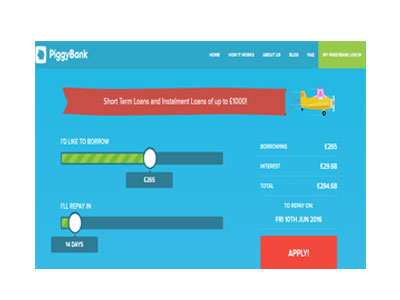

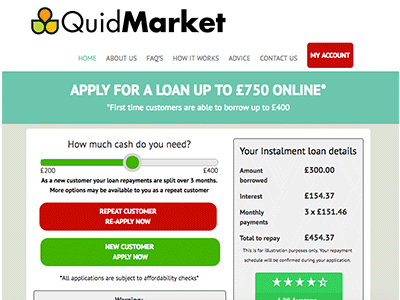

Slightly improvised from personal loans, short term loans offer consumers loans of smaller amounts that are payable over shorter repayment terms.

Generally speaking a short term loan is repaid in full within 12 months. Instant and payday cash loans offer shorter repayment terms that can range anything from one month, three months, up to 12 months. These loans can either be secured or unsecured, but due to the smaller loan amounts, these loans are often unsecured, and easier to get approval for.

Short-term loans offer quick cash solutions

With short term loans, consumers do not have to commit to long term debt, and as the loan is repaid in a short period, the interest rates can be very competitive. The process to apply for a short term loan is fairly easy and straightforward. You can either apply online, by telephone, or at a lender branch, depending on the methods used by the lender in question.

Your short term loan can be used for a variety of purposes, from holidays, unexpected expenses, purchasing items, and more. It is one of the most beneficial features of a short term loan.

How to get a short term loan

Short term loans of any kind are most commonly found online by a variety of different online loan providers. There is an option to suit your needs best. From peer to peer lenders, credit unions, banks and more contemporary lenders; we have compiled an insurance comparison platform that makes it easy to find the best short term lender in the UK.

Short term loans vs payday loans

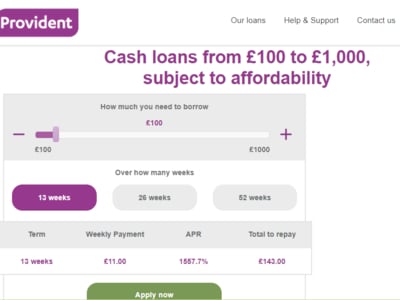

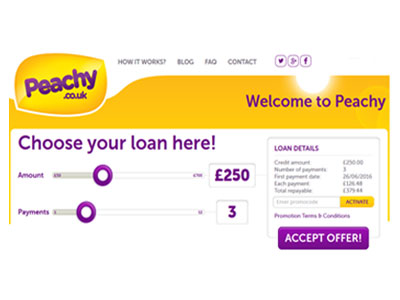

Payday loans offer smaller loan amounts with repayment terms of up to 40 days, generally, as the name suggests, by your next payday. Short term loans offer slightly higher loans amounts over longer repayment terms that could range from three months to one year.

Top features of a short term loan

- Wide range of loan amounts available

- Ideal for smaller expenses and purchases of almost any nature

- You can secure competitive interest rates if you have a good credit score

- Short term loans are available to people with bad credit, usually with different bad credit loan terms and conditions

- You can complete an online loan application at your convenience

- No need to offer collateral to secure your loan

- Repay the loan in anything from three to 12 months

- You can get your loan on the same day with speedy turnaround times offered by many lenders that form part of our extensive comparison website

Other important short-term loan features

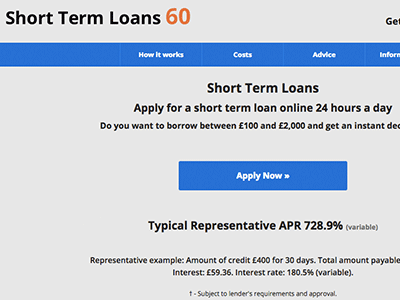

- Short term loans usually have higher interest rates than long term loans such as personal loans and vehicle loans

- There is usually a smaller loan amount limit

- People with bad credit may have to pay higher rates

- Non-payment and late-payment fees can be very pricey

How do you know if you qualify for a short term loan?

Compared to long term loans, it is easier and quicker to apply for a short term loan. In the vast loans industry, lenders compete to offer the quickest turnaround times, with the easiest applications available. It gives you competitive offers to choose from, and you can do this by using our platform.

There are usually some basic requirements that borrowers are required to meet, which may include but not be limited to the following:

- You must be aged 18 or over

- You must be a UK citizen or permanent resident

- You must be employed in a full time position or self-employed, some lenders provide loans for those on benefits or alike

- You will be required to provide a photo ID

- You might be asked to provide two or three recent payslips and/or your bank statements

- You will also need to have an active bank account and email

The short term loan difference

More often than not, short term lenders typically operate online and offer 100% online loan applications. Any many cases you can expect higher interest rates and fees that are associated with short term loans. The one benefit of short term loans is that individuals with bad credit have options available to borrow money.

The flexibility that you can expect from a short term loan is thus greater than other loan types. Most short term loans do not require security, which streamlines the loan application process to be faster. Another added benefit is that consumers are able to find personalised short term loans that cater to their specific requirements.

How to find an affordable short-term loan

The golden rule is not to accept the first short term loan that you are offered. Shopping around and making use of loan comparison websites pays off and can be what ensures that you find the best short term loan deal in the UK. This is where we help you. We offer you the convenient loan comparison website that allows you access all the essential information on the best lenders in the UK. Our clients make informed loan decisions by following this method.

What to keep in mind when comparing lenders

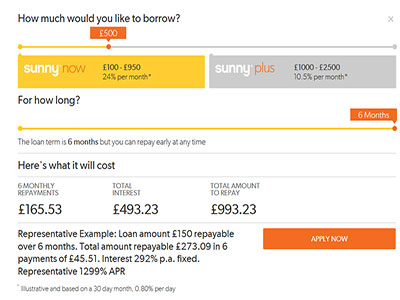

It is important to compare the interest rate of each lender. Ensure that you are looking at the same representation of interest, whether it is daily interest rate, monthly interest and so forth. However, it is strongly suggested that you view the APR of each lender as this will include the entire cost of the loan, and not just the interest rate.

Some lenders are more transparent about their fees and others not as much. When choosing a lender you have to make sure you know of all the fees, and other related costs involved to avoid a short term loan costing you more than you budgeted for even if you are searching for a fast cash loan that can be paid out on the same day.

Important things to consider

- The repayment term of the loan

- Whether you meet the minimum criteria for a loan

- If you can afford the monthly repayments and the loan will not affect your financial wellbeing

- What the interest rate is and what the comparison rate is

- The non-payment fees and penalties

- The turnaround time of the loan application

- What supporting documents are required and if you are able to provide these